USA and Canada

North American spring crops in poor condition

THE weekly United States Department of Agriculture (USDA) Crop Progress Report, released on Monday night each week, revealed two major factors impacting wheat prices last week.

The first is that the winter wheat harvest is finally gathering pace, with 17 per cent of the crop in the bin.

While this lags the average pace of 26pc, new supplies are hitting the US market, and peak harvest pressure on the market is just around the corner.

Chicago Board of Trade (CBoT) Soft Red Winter wheat futures have come under harvest pressure, and while the May price lows, and the June lows to date, may hold, harvest is becoming a factor in preventing the market from moving aggressively higher.

Read More…

US Industry Taking Action on Fresh Blueberry Retail and Promotion in China

With fresh U.S. highbush blueberries having received market access to China in 2020, the product is set to have its first formal promotional activities in China this year. On June 17, the U.S. Highbush Blueberry Council kicked off its inaugural China campaign with a webinar and virtual meet-and-greet between U.S. blueberry growers/exporters and Chinese retailers. Despite the challenge of a high tariff rate, both U.S. exporters and Chinese importers/retailers expressed an eagerness to work together to bring fresh U.S. blueberries to China.

The event was moderated by Alicia Adler, vice president for global business development at USHBC, and featured welcome remarks from Chris L. Bielecki, deputy director at the USDA Agricultural Trade Office in Beijing.

Read More

Soybean rise to US $ 532 a ton in Chicago

The price of soybeans sprang back to above US $ 500 in the Chicago market Wednesday after a US $ 33.2 rise fueled by a new report on stocks and planting from the Department of Agriculture of the United States (USDA).

As the new document featured data operators had not foreseen, July’s figures increased 6.64% (US $ 33.16) to US $ 532.78 per ton, while the August position grew 6.74% (US $ 33.16 ) to settle at US $ 525.43 per ton.

The cereals market also registered a strong increase, with a jump in corn of 3.67% (US $ 10.04) which placed it at US $ 283.45 per ton; while wheat showed a growth of 4.96% (US $ 11.67) at US $ 246.73 per ton.

The new USDA report showed an area planted with soybeans of 35.43 million hectares for the new season in the US, almost 600,000 hectares below market projections, of 36.01 million hectares on average.

Read More…

Canadian beef sector targets German market

Exporters attempt to find ways to improve on the $61,000 worth of sales it made to the European country last year

With a population of 83 million and the fourth largest economy in the world, Germany is an attractive market for Canada’s agri-food industry.

Some agricultural producers, like Canada’s maple syrup sector, have had success in the German market. In 2019, Canada exported $42 million worth of maple syrup to Germany.

That’s positive, but other agri-food exporters haven’t been as successful.

Read More…

Expect Higher Seed Corn Prices this Fall

Most farmers understand that the price of seed corn tends to go up during good economic times on the farm. Gary Schnitkey at the University of Illinois used the state’s Farm Business Farm Management records to quantify this idea.

“What we did was to look at the seed corn cost and two things (stand out). The first is that generally during higher expected revenue periods seed corn costs tend to rise. We saw rising revenues in 2020, and expect this to continue into 2021 and this would lead us to believe seed cost will rise in 2022.”

The ag economist expects seed corn costs to increase by $6 to $10 per acre. Since 1975 Schnitkey says seed costs as a percentage of expected revenue per acre has been increasing. “It started as four percent in 1975. So, in 1975 seed costs as percent of expected revenue was four percent and now we over ten percent.

Read more…

New Zealand

Meat industry nears critical shortage of halal butchers, other staff

A $3.5 billion-dollar export industry is at risk if the country does not get more halal butchers, the Meat Industry Association says.

Sirma Karapeeva, the association’s chief executive, pressed Parliament’s primary production select committee on Thursday for urgent help to bring in more migrant halal workers for the upcoming processing season.

The shortage is part of a wider labour shortage. Karapeeva said every year the industry swelled its ranks with about 500 unskilled workers to free up seasoned workers. But this year the country was short about 2000 workers, skilled and unskilled.

Read More here…

Kiwifruit growers vote against Zespri’s effort to commercialise unlicensed Chinese fruit

Kiwifruit growers have voted against Zespri’s proposed trial to commercialise unlicensed SunGold kiwifruit that is being grown across China.

Zespri signed a memorandum of intent with a Chinese state-owned enterprise in November to buy and brand the SunGold kiwifruit being grown without its agreement in Sichuan Province. Zespri hoped the deal would allow it to commercialise some of an estimated 5400 hectares of SunGold kiwifruit being grown in China on vines that were stolen from the company.

But the company – after considerable effort and support from the government – has failed to receive the support of 75 per cent of the industry’s 2792 growers, as required under its regulations, to proceed with a one-year trial of the commercial arrangement.

Read More here…

Govt inquiry into seafood industry focuses on migrants

The Government has launched a ministerial inquiry into the use and allocation of migrant labour in the seafood sector.

Oceans and Fisheries Minister David Parker said Covid-19 border restrictions had highlighted the need to attract more New Zealanders into fishing and processing.

“Some businesses in the sector have reduced their reliance on migrant workers since border restrictions were imposed, but some deep sea vessels in particular are still 100 per cent foreign-crewed,” he said.

“The inquiry will do a stocktake of the current state of the seafood sector’s workforce and determine what a more resilient seafood workforce – with a greater proportion of New Zealanders – could look like, and how this might be achieved.”

Read more here…

South Island hill and high-country sheep farms are big and profitable but have limited options

In previous articles, I first described the North Island’s 4000 commercial hill-country farms (Beef+Lamb Classes 3 and 4). Subsequently, I wrote about the approximately 4400 intensive sheep and beef farms that are spread across both North and South Islands (Beef+Lamb Classes 5, 6, 7 and 8). That left the story of 620 South Island hill-country farms and 200 high-country farms to be told here. It is a contrasting story.

The combined number of South Island hill and high-country farms is modest, comprising less than ten percent of the 9200 commercial sheep and beef farms in New Zealand. However, these farms comprise more than one third of New Zealand’s total sheep and beef grazing area.

Read more here…

Food, sustainable food: We’re anxious to buy it, but where’s the beef?

Kiwi consumers are increasingly demanding food that is ethical and sustainable. However, hurdles remain including pricing and access, as Chris Marshall reports.

Wholly Cow Butchery can trace beef, lamb and goat products from pasture to plate.

Owners Tom and Carrie Andrews have an abattoir and a retail butchery shop, and farm the animals on their own 186-hectare property using holistic land-management practices.

“You know the beef you’re killing is 100 per cent yours, and it’s pretty much stress-free,” said their son Luke Andrews, who manages the butchery.

Read More here…

Australia

Crop prospects high across virtually all key grain growing regions

AUSTRALIA is on track for another big crop if the current seasonal conditions continue throughout the remainder of the growing season.

As true winter sets in across the nation only an area of the Mallee across South Australia and Victoria, along with parts of the small broadacre cropping region in Central Queensland have markedly below average season prospects.

Unusually many parts of Queensland, NSW, eastern Victoria and Western Australia are on the cusp of being too wet, especially with short days and low evaporation rates.

There is a significant rain bearing system due to deposit over 25mm in the next week over much of the Darling Downs and northern NSW and in contrast to recent years many farmers are hoping to avoid the rain.

Read more here…

Wool campaigns prove popular

COVID induced marketing campaigns by Australian Wool Innovation have increased gross merchandise values and woollen garments sold across the world.

AWI director Don Macdonald told the MerinoLink audience the peak wool body identified China’s economic recovery before any other key wool markets, and they acted on it.

“Of that 60 per cent dedicated marketing founds we recognised it wasn’t the time to pour money into projects that we believed wouldn’t yield,” Mr Macdonald said.

Read more here…

Dairy Situation and Outlook June 2021 report reveals big lift in dairy confidence but only modest growth tipped

Dairy farmer confidence levels have leapt in the past year on the back of good seasonal conditions and strong milk prices that have lifted farm profitability levels.

But the improved confidence has not translated into increased national milk production, with minimal change in the past 12 months.

Dairy Australia’s June 2021 Situation and Outlook report released on Wednesday pointed to high beef prices and strong land values as continuing to encourage dairy farm exits.

And it said labour shortages were a big concern for dairy farmers across the country.

Read more here…

Bleaching concerns surround new herbicide

FARMERS have expressed concern regarding the performance of FMC’s new herbicide Overwatch, in particular in regard to excessive levels of bleaching in crops treated with the product and with potential concerns about off-target damage.

FMC always noted that there was likely to be some level of crop bleaching with the Group Q product, which was released to much hype as a new mode of action to combat ryegrass, but farmers are worried the impacts have been more severe on the crops sprayed than they anticipated.

As well as the in-crop concerns there are worries about what appears may be off-target damage to nearby crops.

Read more here…

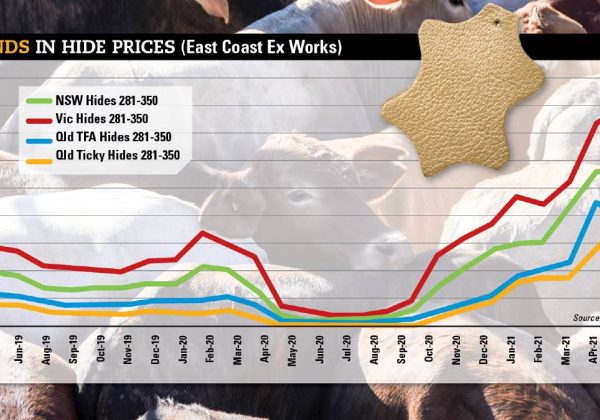

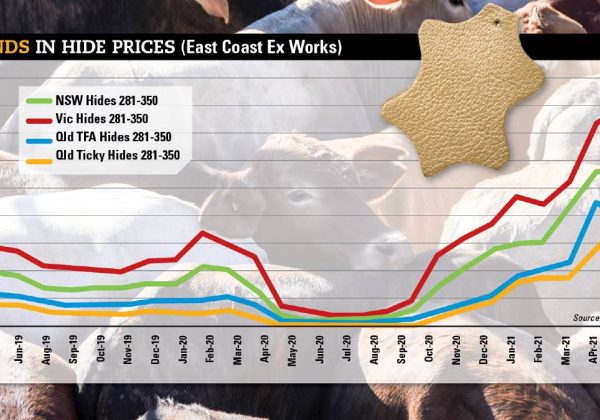

Cattle shortage pushes offal, hide prices up

HE global shortage of cattle is making itself felt in the offal market, combining with ongoing ramped-up demand on the back of the pandemic to push prices significantly higher that year-ago levels.

Most beef co-product prices are higher than month-ago and year-ago levels, with tongue, lips, cheek and tails leading the charge, while sheep hearts have been in strong demand.

Hides, too, continue on a sharp upward rise. In some categories, the increase year-on-year is now as much a 8100 per cent, with the hide price lifting from 25 cents a piece to $20.50.

he latest Meat & Livestock Australia co-product report shows heavy Victorian hides are now making as much as $49 each.

Read more here…

South America

Uruguayan meat processing plant may resume shipments to China after labelling incident in April

The Uruguayan BPU meat processing plant has been cleared to resume exports to China as of July 1 after it was banned April 9 due to a mislabelled shipment, it was announced Thursday.

The lifting of the sanctions brought relief to BPU, who allocates 70% of its output to that market.

BPU’s sales to China had been suspended on April 9, when an error was found by the Ministry of Livestock, Agriculture and Fisheries in the labeling of the boxes, which led to the dismissal of of two officials and somehow added to the cauases of removal of Livestock Minister Carlos Uriarte earlier this week.

Read More here…

Argentina says producers have sold 23 million tons of 2020/21 soybean crop

RIO DE JANEIRO, BRAZIL – Argentina’s producers have sold 23 million metric tons of soybeans from the 2020/21 season after recording transactions totaling 518,800 tons last week, the Agriculture Ministry said Tuesday in a report updated to June 23.

The pace of soybean sales is behind that of the previous season. At the same time last year, 25.8 million tons of soybeans were sold, according to official data.

According to the Buenos Aires Grain Exchange, Argentina’s current 2020/21 soybean crop is estimated at 43.5 million metric tons, compared with 49 million metric tons harvested the previous season.

Read More here

Frost causes corn loss in Brazil

A mass of cold air has hit Brazilian regions where safrinha corn (second crop corn) is produced, and although it is early to say because the frost just happened this Monday and Tuesday, producers are indicating that at least 50% of the production is suffering – some farmers even risk saying yield losses of 70% to 90%.

The mass caused a strong frost to arrive in the mid-south region of Brazil. Frost formations like these have not been seen in the country for a long time. Such weather also damaged coffee and sugar cane productions in São Paulo, Mato Grosso do Sul, and Paraná.

The corn production of Paraná state that was already impacted by the dry weather throughout the season now faced frost and temperatures reaching 24 F, very low and atypical for the tropical Brazil. There is no doubt: the impact of the cold will reduce even more the size of this year’s corn harvest.

Read more here

Food Updates

The flavour challenge of plant-based

The plant-based market may be booming, but challenges in terms of matching their meat counterparts may leave innovators feeling at a loss. Sound familiar? Here’s what to do…The European plant-based market is expected to reach a value of €18.3 billon by 2023, so it’s certainly a worthwhile investment…if you can meet the challenging demands of the consumer.

Kerry research shows that 37 percent of plant-based protein consumers in Europe want better tasting products and 26 percent want a better range of products to choose from. However, the balancing act between masking and overdosing is a precarious balancing act.

Read more here…

Study confirms heart health benefits of Mediterranean diet

Researchers in the United States have confirmed the prevalent belief that a Mediterranean style diet can help protect against heart diseases.

With almost one in nine deaths in America attributed to sudden cardiac death (SCD), researchers sought to identify more precise links between diet and heart health. The Mediterranean diet has been widely praised for its abundance of vegetables, fruits, whole grains and unsaturated fat, giving it a reputation for providing good health and long life.

The results of a long-term study in the US, published in the Journal of the American Heart Association JAHA, have identified the greater the adherence to a Mediterranean diet, the less likely you are to suffer cardiac arrest.

Read more here…

Battle of the snacks: healthy or indulgent?

New Food’s Editor, Bethan Grylls, examines the polar opposite trends of indulgent and healthy snacks and places her bets on how the future will unfold.

We’ve been seeing two distinctly opposing trends running parallel with equal success over the last couple of years. On one side of the ring is the healthy snack – flooding our social media feeds as much as the exercise influencer’s next HIIT routine – and on the other is the decadent snack, oozing indulgence and offering comfort during tough times.

So how has this happened and which snack will win the hearts of consumers?

Read more here…

Europe’s soft drinks industry makes ambitiou

UNESDA, representing Europe’s soft drinks industry, has announced new health and nutrition commitments, including a pledge to reduce average added sugar in soft drinks by an additional 10 percent by 2025.This latest drive to help consumers manage their intake of added sugars via soft drinks will mean a 33 percent overall reduction in average added sugars over the last two decades.

“This additional 10 percent reduction in added sugars underlines our sector’s collective proactivity and determination to contribute to healthier and balanced diets in Europe,” said Ian Ellington, UNESDA President and Senior Vice President and Chief Category Officer at PepsiCo Europe. “We will continue to bring innovation and choice to consumers as we implement this pledge.”

Read more here…

The sustainable future of food in the workplace

The catering industry is responding to an increased focus on health, wellbeing and sustainability. The challenge: to provide wholesome food that meets crucial corporate social responsibility targets, while answering consumer demand for nutrition. Ryan Holmes considers whether seasonal supply chains and plant-based diets hold the answer.

Utilising British supply chains: an essential in 2021

We are all used to seeing an unseasonal array of produce practically everywhere we go to buy food. The UK is reliant on imports, which account for just under half of the total food consumed across the nation.1 The main exporter of food to the UK is the EU, with Africa, North America, South America and Asia exporting roughly the same amount each (in 2019, this accounted for 12 per cent of food consumed in the UK). Each year, the value of food imports to the UK is billions greater than British exports.

Read more here…