USA and Canada

Carbon tax refund for grain drying urgently needed: GFO

Grain Farmers of Ontario (GFO) is urging the federal government to create an exemption on the Carbon Tax that it is currently levying on Ontario grain producers immediately, and to issue a rebate of taxes paid to date.

On Dec. 14 a tax credit was announced in the federal government‘s Fall Economic Statement that still does not provide Ontario grain farmers with relief from carbon tax paid on fuel to dry grain. The Federal Carbon Tax levied on farmers is an expense that cannot be borne by farmers growing food, the GFO said in a release. “In Ontario grain drying is a necessary part of producing high quality, healthy, viable grains – you can‘t make bread from spoiled grain,” the GFO said.

It said Ontario farmers cannot compete with U.S. farmers who don‘t have to pay the carbon tax to grow their grain.

Read More…

Resistance to resistance – future control today

Herbicide-resistant weeds cost Canadian farmers more than half a billion dollars annually and the price tag is growing. The next generations of producers might not be any better able to control the problem than we are today.

There are wild oat populations displaying resistance to Groups 1, 2, 8, 14, and 15 herbicides, kochia populations showing resistance to Group 2, 4 and 9 herbicides, and Palmer amaranth has reared its ugly head in a Manitoba field. In the United States, Palmer has shown resistance to Group 2, 3, 5, 9, 14 and 27 herbicides.

The Canadian experience fits the global trend. The International Survey of Herbicide Resistant.

Weeds keeps a running tally of weed species with multiple resistance.

To the end of 2020, the survey documented 60 weed species around the globe with resistance to two modes of action, 21 resistant to three modes of action, 13 resistant to four modes of action, six resistant to five modes of action, and one weed species resistant to six modes of action.

Read More

New technology may soon be unaffordable for mid-sized farms

Near-future farmers might have to finance farm equipment as if they want to keep it forever.

With fewer mid-sized farmers looking to buy used from larger operators, there might soon be no market for gently used farm equipment.

Considering that resale values are key to how much farmers can invest in innovative technologies, that could be a problem.

“I don’t know who’s stepping up to buy some of this used equipment,” said Al Mussell of Agri Food Economic Systems, an economic analysis firm.

“Some of this stuff, there’s no way it’s going to sell three or four times.”

It’s part of a problem Mussell and Douglas Hedley focused on in recent research. They found a big gap developing between the biggest and the smallest farms, with the traditional bulge of medium-sized farms between the two disappearing over recent decades.

Read More

Looking back at 2021: Drought, markets and more

With one of the more severe droughts on record in the region striking in 2021, weather conditions hit livestock producers, crop producers, markets and more. And though drought certainly was tied to some of the other big stories of the year, it certainly wasn’t the only story. Here are a few others that caught attention in 2021.

With one of the more severe droughts on record in the region striking in 2021, weather conditions hit livestock producers, crop producers, markets and more. And though drought certainly was tied to some of the other big stories of the year, it certainly wasn’t the only story.

At the beginning of 2021, wheat was a mere side note to the acreage battle between soybeans and corn. Soybeans were flying high, with corn coming along for the ride to maintain acres while questions about ethanol demand remained.

Wheat, though? “I see wheat as being a follower,” DuWayne Bosse with Bolt Marketing said in Agweek’s first market outlook of 2021.

Weekly Grain Movement: Wheat exports soar

Wheat export shipments for the week ending December 23 saw a bullish bump from the previous week, thanks in large part to a competitive global export market. Wheat shipments to international customers from U.S. terminals rose 76% on the week to 12.3 million bushels – a four-week high for weekly wheat exports.

Weekly wheat export loading paces have been particularly lackluster over the past 10 weeks, averaging a mere 8.5 million bushels per week. So today’s report was a welcome reminder that there are potential trade opportunities available for U.S. wheat exporters, especially as top exporter Russia weights an export quota during the first half of next year and continues to increase its wheat export tax multiplier.

Lower freight costs on shipments to close-by distances continue to be a deciding factor in global grain purchasing decisions. Last week’s wheat shipments were primarily destined for Japan (3.3M bu.), Colombia (1.7M bu.), and Mexico (1.6M bu.).

Read more…

New Zealand

What farmers are hoping for in 2022

If New Zealand beef and lamb farmers were asked what they hoped for in 2022, the answers would be quick: two inches of rain, a slowing of rising land prices, reliable supply chain, consistent kill cycle, good product prices, the ability to manage political change and good staff.

There are more than 44,000 people employed in New Zealand’s meat and wool sector, and the scarcity of seasonal and specialist workers is an ongoing challenge. The one thing farmers can do is to keep the staff they have and grow the next generation of farmers.

Wairarapa farmer Derek Daniell says teamwork is what farming is all about. He knows of farms that have had the same staff for 30 or 40 years, even if the ownership has changed.

“It is about working together as a team and enjoying each other,” he said.

Read More here…

Marlborough hemp farm overcomes challenges to get organic status

A rural Marlborough hemp farm has achieved an organic certified status but it hasn’t been without its challenges.

Puro, which began planting in December 2020, commercially cultivates cannabis for medical use in Kēkerengū, north of Kaikōura.

BioGro, New Zealand’s largest certifier for organic produce, granted the organic status after working with Puro for the past two years. The achievement is a first for any medical cannabis company in Australasia.

Puro quality and compliance manager Wendy Tillman said Puro’s commitment to growing organically had not been without its challenges.

“We are a very new industry here in New Zealand and one of very few organic growers worldwide,” Tillman said.

Read More here…

Beef cattle numbers increase in 2021

Beef cattle numbers increased in 2021 while the number of sheep in the country’s flocks dropped slightly, Stats NZ said.

Provisional figures from the 2021 agricultural production survey show beef cattle numbers increased to 4 million at June 2021, a 4 per cent or 142,000 increase from the previous year.

“The total number of beef cattle was at a historical low in 2016, however it’s been increasing and is now up by 492,000, or 14 per cent, since that time,” agricultural production statistics manager Ana Krpo said.

Good beef prices throughout this period contributed to this increase.

The number of sheep nationally has been steady compared with the previous year, at 26 million. The lambing rate was also consistent with the previous year.

Read More here

Union wants controversial chemical banned immediately, ahead of kiwifruit harvest

A union that represents agricultural workers is calling for an immediate ban on a controversial agrichemical ahead of the upcoming kiwifruit harvest.

First Union wants the Environmental Protection Authority (EPA) to disallow the use of hydrogen cyanamide, an active ingredient in sprays commonly used by kiwifruit growers to help buds form after winter.

Commonly known as Hi-Cane, the chemical has been banned in Europe and its re-registration is under review in the United States of America.

First Union strategic project co-ordinator Anita Rosentreter said hydrogen cyanamide caused skin and eye irritation.

There was also evidence of it having a carcinogenic effect on those exposed to it, Rosentreter said.

Peanut farming could bring jobs and money to Northland as trial gets under way

People in Northland could soon be working for peanuts if a Government-funded trial finds growing the legumes on a commercial scale is viable.

Nearly $700,000 is being spent on large-scale trials after a smaller one recently proved peanuts could be farmed in the north of the country.

Over the next two years, a group of farmers will grow them at seven sites across the Kaipara and Far North Districts, with an aim at finding out if the venture could sustain an industry, Northland Inc’s Vaughan Cooper said.

He hoped the experiment would provide the “conclusive evidence” investors, landowners, growers and farmers needed to have confidence to diversify into peanut growing.

Australia

Conditions deliver a great season in WA

THE combination of a wet season and good prices for the majority of commodities set most growers in Western Australia up for what should be their best ever year.

That was the key message behind a review of the 2021 season provided by research scientist Dion Nickol and climatologist Ian Foster, at the Department of Primary Industries and Regional Development’s (DPIRD) Grain Industry Day, held at Optus Stadium earlier this month.

There was undeniably a lot of rain around this year and the signs were positive from the start about what was going to be the potential set-up for a good season.

Most of the State, including the north eastern areas, had abundant summer and autumn rainfall which created ample soil moisture and early sowing opportunities.

Read more here…

Falling numbers vary with each variety

WHEN it comes to the management of pre-harvest sprouting and falling numbers, growers should ensure they’re making an appropriate variety choice and matching it with an appropriate sowing time.

Department of Primary Industries and Regional Development’s (DPIRD) research scientist Jeremy Curry made this recommendation at a recent Grain Industry Day in Perth.

The falling numbers test provides an indicative measure of alpha-amylase, the enzyme that breaks down starch into sugars, in the grain and is conducted at receival sites where suspected pre-harvest sprouting damage has occurred, determined by detection of visually sprouted grains.

With alpha-amylase being negatively attributed with baking quality, excessive levels in grain results in downgrades and a minimum falling number of 300 is required for delivery into most receival grades.

The likelihood of a crop exhibiting low falling numbers is the result of complex interactions between the genetics of the variety, the environmental conditions it is exposed to, and at what growth stages these environmental conditions occur.

Read more here…

Looking back at 2021 grain market influences

AS we come to the end of 2021, we look back at what influenced grain markets throughout the year.

A record Australian winter crop, poor production in Canada/United States and Russian export duties are a few factors we will review.

Australian winter crop

Coming off a reasonably large cropping season in 2020, it was a nice surprise to get another bumper year in 2021.

Above average rainfall across most of the country helped to boost root zone soil moisture and aid crop development.

Read more here

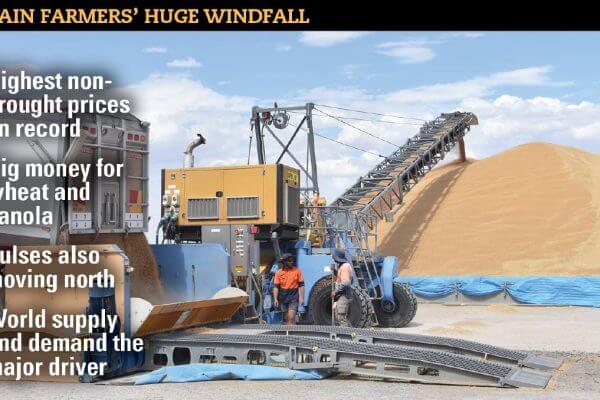

2021 tops all comers for grain prices

A FAVOURABLE supply and demand equation has seen grain prices hit records at an international level throughout much of 2021.

Fortunately for many Australian farmers, unlike many years of high grain prices, they have enjoyed average or better crops meaning they are able to cash in on the boom.

Long-time grains industry analyst Malcolm Bartholomaeus, Bartholomaeus Consulting, said while there had occasionally been prices challenging current levels it had not happened in years of good production.

“We have seen regional drought premiums kick prices to high levels but this is the best year overall,” Mr Bartholomaeus said.

Read more here…

Innovation critical to boosting ag revenue

INNOVATION will play a critical role in boosting Australian agricultural revenue according to the managing director of farm innovation accelerator Farmers 2 Founders.

Christine Pitts said she was upbeat about the prospects of agriculture in coming years, but said to unlock its full potential those on each side of the agri problem solving equation needed to know how to link up with each other.

She gave the incredible stat that individual producers could increase their returns by 250 per cent during the current ag boom, but qualified this by saying only by closing the massive gap between those with problems, solutions and commercialisation capacity would this be possible.

Dr Pitt said a key part of F2F’s charter was better linking in farmers and those who can help boost productivity, such as researchers and corporates with R&D capacity, and frontline agriculture.

Read more here…

South America

Report gives Argentina wheat forecast boost

BUENOS AIRES, ARGENTINA — Citing better-than-expected yields, the Buenos Aires Grains Exchange has upped its 2021-22 wheat crop estimate for Argentina to 21.5 million tonnes from its previous 21 million tonne forecast, according to a Reuters report.

Soybean and corn crops also will get a boost from better rains in January, weather experts said.

In its Dec. 23 report, Buenos Aires Grains Exchange said the Argentine wheat harvest is 78.3% completed and expected to end in January.

“The national average yield has reached 3.28 tonnes per hectare over the last seven days,” the exchange said. “Sustained improvement in harvested yields allows us to raise our production projection to a new record.”

Read More here…

CORN, SOYBEANS MIXED, WHEAT HIGHER ON EXPORT SALE

Soybeans closed mixed after trading lower for most of the day Wednesday, finding a market correction following a nearly 10-day streak of closing higher, which ended Tuesday. January beans closed two and three quarters cents lower at $13.56 and the deferred May contract closed two and a quarter cents higher at $13.77. Soybean meal demand seems to be limiting some of the bearish action but, ultimately, the January contract closed 50 cents lower at $415.40. A strong soybean basis is creating strong soybean meal demand, but that strength could be limited on extended feed stock demand. Soybean oil bounced higher, up 15 points at $56.70. Export sales are down for both corn and beans with soy exports down nearly 25 percent compared to this time last year. Meanwhile, Brazil is projected to have a sharp increase in soy exports. South American weather remains a key focus with continued drought conditions in most parts of Argentina and Brazil, rain in the extended forecast could reverse the bullish weather pressure in the market.

Read more here

Brazilian Grain Harvest Could Break Records

The 2021/2022 grain harvest in Brazil could reach 291 million tonnes due to the sector’s confidence in prices and the superb performance of national agriculture.

The assessment was made by the minister of Agriculture, Livestock, and Food Supply, Tereza Cristina, interviewed last week on the Brazilian national radio show ‘A Voz do Brasil.’

“Several aspects have contributed to the increasing rural production. We expect and estimate a record harvest with a growth in the cultivated area and an increase in production and productivity. This is an excellent estimate,” said Tereza Cristina.

She says the numbers may fluctuate a little more or less, depending on the rainfall in the country.

Read More here…

Brazilian corn fields hurt by poor weather

Not long ago, during the last season of corn, there was a break in the Brazilian production that reached more than 50% in some regions. Farmers are fearing that the same thing will happen this season. La Niña has struck hard, especially in the south region, affecting the production with severe dry spells.

According to NOAA, the expectations are that the phenomena will last until October of 2022 in the southern hemisphere, with its peak happening right now and in January. The effects will be felt by farmers all the way until May (fall season in Brazil) with cold fronts arriving earlier, increasing the risks of early frosts in the south.

In Rio Grande do Sul, the lack of rains might continue for the next months, and in Paraná and Santa Catarina, the drought period is expected to give a truce in January – but it won’t last long. The dry weather is expected to come back already in February. Either way, all 3 states will have a low average of rains during the Brazilian summer season. Meanwhile, the northern states, like Mato Grosso and Goiás, will have rains above average and this excess can harm the field work, besides being a risk to the summer harvest.

Read more here…

Food Updates

What trends can the food and beverage industry expect in 2022?

Paul Baker, founder of St Pierre Groupe, comments on what 2022 might look like for the food and drink industry in general, and the bakery sector specifically.

I recall compiling my trends forecast last year and giving a wry smile at how any forecasts for 2020 had probably long-been proven wrong and that the idea of trying to predict 2021 seemed laughable.

This time round, and with new restrictions being announced, the impact and aftermath of the pandemic will be felt for a long time to come. A good portion of 2021 has also been spent in and out of lockdown with various pandemic restrictions – and so the habits that we saw emerge in 2020/2021 will be around for a good while yet. Ever the optimist though, these new habits create opportunity and that is particularly true for the food and drink industry.

Bacteriophages to the future

Improving the reliability of microbiological testing

Read more here…

Nutrients put to test for canola yield

A PROJECT looking at optimising high rainfall zone cropping for profit has found that while canola was highly responsive to nitrogen, the majority of other macro and micro nutrients did not have an impact on yield.

The results of the trial, which ran over 2020 and 2021 in Esperance, were shared at the recent Department of Primary Industries and Regional Development’s (DPIRD) Grain Industry Day in Perth.

The project, which was a collaboration between DPIRD, CSIRO and FAR Australia, made possible by investment from the Grains Research and Development Corporation (GRDC), started in 2019 with a series of workshops at Dandaragan, Esperance and Albany.

One of the key questions that came out of those workshops was the idea of nutrition – if growers have addressed subsoil constraints, are using hybrid cultivars and sowing early, then does the nutritional package have to change as they start to achieve yields of 3-4 tonnes a hectare?

Read more here…

Big breakthroughs on canola pod shatter

Qiong Hu, of the Chinese Academy of Ag Sciences, said researchers had identified a gene they believed was responsible for the pod shattering resistance.

Read more here…