USA and Canada

Alarm sounded on canola exports

Canada’s canola exports will fall way short of Agriculture Canada’s forecast and that means increased carryout and pressure on prices, says an analyst.

Agriculture Canada is forecasting 9.3 million tonnes of exports in 2022-23.

That is not the number that PI Financial Corp. canola analyst Ken Ball is hearing when he speaks to commercial traders.

“Some of them are as low as six (million tonnes), some are seven to 7.5,” he said.

The reason for their pessimism is Australia’s monster crop. Farmers Down Under harvested a record 7.3 million tonnes of the oilseed, according to the Australian government’s latest estimate published on Dec. 6.

“Australian exports could hit six million tonnes this year,” said Ball.

Read More…

Crop prices an exception in commodity slump

Commodity markets are facing a bearish 2023, according to most analysts, but bull markets should remain in a number of agricultural commodities.

Unfortunately for farmers, that gleaming outlook is tarnished by the outlook for fertilizers, which are predicted to remain strong and will continue to suck away much of the potential profitability of crop production.

But still, if you’re going to be a commodity producer in 2023, growing crops seems like the best place to be.

As ING notes about wheat in its 2023 Commodities Outlook, “global wheat markets are likely to tighten over the 2022-23 season. Meanwhile, there are already several supply risks building for the next marketing year, which should support prices through 2023.”The report, subtitled Stormy Seas Ahead, doesn’t find the same strength beneath the price outlook for most other commodities.

That’s a bearish outlook shared by most analytical shops, which have been trotting out their 2023 outlooks in the run-up to the new year.

Read More…

Pulse sector faces acre turbulence

There is mounting trepidation about the threat the thriving oilseed sector poses to North America’s pulse industry.

“Most pulse industry people should be concerned,” says Jeff Van Pevenage, president of Columbia Grain International, a grain company headquartered in Portland, Oregon, that handles pulses and other crops.

He thinks 30 percent of the dry bean acres in North Dakota and an equal portion of the green pea acres in Washington and Idaho could eventually succumb to pressure from rapidly expanding soybean and canola acres in those states.

Oilseed crops will be in high demand when all the new crush facilities come online to fuel the renewable diesel plants springing up across the United States.

Read More …

Markets again are looking for direction

The first week of December wrapped up with the grains closing mixed with all three wheat exchanges ending lower, corn steady, and soybeans higher. The lack of demand and expectations that the U.S. Department of Agriculture would lower wheat and corn demand in the December Crop Production report added pressure to those markets while soybeans were supported by recent announced exports sales as well as from South American weather concerns.

Soybean exports picked up the first 10 days of December, with China buying 382,000 metric tons of U.S. soybeans while an unknown destination bought 958,000 metric tons of U.S. soybeans. Japan and Taiwan were buying wheat but no export sales of corn were reported. On the plus side, Mexico has agreed to continue to buy U.S. GMO corn and has even pushed back the implementation date for banning GMO corn for human consumption until 2025.

Soybean and corn advisor Dr. Michael Cordonnier continues to paint a concerning picture for Argentina but not so for Brazil. For the third week in a row, he has lowered Argentina’s corn and soybean production 1 million metric ton each. This has soybean production at 47 million metric tons and corn production at 47 million metric tons.

Read more…

Plan on 2023 being best crop ever, Minnesota scientist says looking at yields despite drought

When thinking about which varieties to plant in 2023, Tom Hoverstad of the University of Minnesota Extension Service, says not to worry too much about the dry late summer of 2022.

“I wouldn’t change any management practices,” said Hoverstad, scientist at the Southern Research and Outreach Center at Waseca. “I would plan on the next crop being the best you ever grew.”

The University of Minnesota recently released results of 2022 variety trials and Hoverstad said the thing that jumped out to him was 200 bushel corn at Lamberton in southwest Minnesota despite a lack of late season rain that has pushed a swath of the state into D3, or extreme drought.

Hoverstad said the strong yields are a testament to the water holding capacity of the soils in the region.

“Here in Minnesota, we are, for the most part, blessed with some soils that can hold a lot of water and that becomes useful later in the season,” Hoverstad said.

Read more…

New Zealand

Why mussels might just be the next new superfood

It could be as simple as ‘a market push’ to make mussels the next superfood, just like blueberries or mānuka honey, said Marine Farming Association general manager Ned Wells.

Wells said having greenshell mussels dubbed as a superfood was one of Marlborough’s Smart and Connected Aquaculture group priorities to help unlock growth in the sector and hit the Government’s $3 billion goal.

“We think that our mussels are fantastic, and we know that they’ve got a lot of properties that are really good for health.

“We think that more people should be eating our greenshell mussels, whether it’s in a food format or a nutraceutical format, and one way to improve uptake would be to have people thinking of them as a superfood.”

Read More here...

‘The city-dwellers do not understand the mental and physical strength it takes’

On Clovalley Farms, the cost of feed, fuel, fertiliser and electricity has gone up by about 20% this year, and dairy farmers Sophie Cookson and Donovan Croot have had to make major adjustments to keep the business going.

“We have had to look to other sources of income,” Croot said.

Cookson is employed part-time with Cow Manager, a herd management system, and Croot is a tutor for Dairy Training, which provided further education for the dairy sector.

The pair had also diversified their business and now raised some bull calves and sold them in the meat trade, he said.

Read More here…

Beef farmers are looking for efficiencies to deal with both the cost and climate change pressures. Pat Crawshaw discusses how the INZB program is helping that search

This week farmer Pat Crawshaw discusses the Informing New Zealand Beef program. This program focuses on breeding objectives and traits, important to New Zealand farmers. It will also develop a New Zealand-based genetic evaluation for comparing bulls of different breeds, which will ultimately result in more efficient beef animals, that aim to generate less greenhouse gases and to return higher profits.

So what are the areas of focus for the program? Genetics would have to be a significant part in this program so asked Crawshaw about the genetic objectives and targeted outcomes.

Informing New Zealand Beef is a seven year program to provide local beef farmers with the ability to breed animals better suited to this country. It will develop tools for our unique farm systems, in particular a NZ-specific genetic evaluation.

Read More here…

Farmer confidence has fallen dramatically since last quarter and is now at the lowest level recorded in the 20-year history of the Rabobank survey. Government policy and rising farm input costs were the major concerns

Despite the rural sector having performed strongly through a number of recent challenges, New Zealand farmer confidence – which was already at low levels overall – has plummeted further and now sits at an historical low, the latest Rabobank Rural Confidence Survey has found.

The fourth and final survey of 2022 — completed late last month — found farmer confidence was significantly down on the previous (September) quarter, with the net confidence reading slumping to -71 per cent, from -31 per cent previously.

The latest net confidence reading is the lowest in the 20-year history of the survey and far exceeds the previous low of -45 per cent recorded amid the dairy downturn in 2015. The latest survey found the number of farmers expecting conditions in the agricultural economy to improve in the coming 12 months had fallen to four per cent (from 12 per cent in the previous quarter) while the percentage expecting conditions to worsen rose to 75 per cent (up from 43 per cent). A total of 19 per cent were anticipating the agricultural economy to remain stable (down from 44 per cent previously).

Read More here…

Australia

Harvest records set to be broken in WA: GIWA

EXCEPTIONAL yields are making it a certainty that Western Australian growers will see another record season for 2022-23, according to the Grain Industry of Western Australia’s (GIWA) December Crop Report released today.

In the December wrap-up, GIWA is estimating a total crop production of 24.747 million tonnes (Mt), far above the 2021-22 record of 24Mt.

This result is making it a year to remember across all WA grain growing regions, mostly for the yields achieved, but also for those in the southern regions with the unseasonal weather leading up to and during harvest.

Grain yields are in some cases “the best ever”, and in most cases, growers average paddock yields are higher than in 2021, which drove the record tonnage for the state by a fair margin.

Read more here

October canola exports plunge to 42,997t

AUSTRALIA exported 42,997 tonnes of canola in October, 75pc below the September total of 170,970t, according to the latest export data from the Australian Bureau of Statistics (ABS).

October is typically the low month for Australian canola exports, with the October 2021 figure totalling 14,418t, down from 102,597t shipped in September 2021.

In October 2022, Japan on 27,831t appeared to be the only bulk customer.

Australia’s 2022-23 (Oct-Sep) canola crop was forecast by ABARES at a record 7.3 million tonnes.

The flow of new-crop cargoes to Europe and other destinations has already started, and while consecutive rain events have limited New South Wales production, other states are on track for bumper years.

Read more here …

Feedgrain Focus: North firms, south sags

SURPRISINGLY high quality from the Queensland harvest has tightened availability of nearby feedgrain in the northern market, while in the south, prices have eased.

A run of ideal harvesting weather has seen big tonnages of wheat and barley of variable quality hit the southern market.

While southern stockfeed millers know plenty of grain is available, short weeks and shutdowns over the Christmas and New Year period have quashed nearby demand.

Northern barley jumps

The northern feed barley market has risen $15/t in the past week to reflect the limited availability of F1 barley as preferred by many feedlots.

One trader said the rally has come about because barley has either exceeded expectations by making malt specifications, or come in at below the F1 minimum test weight of 62kg per hectolitre.

Read mpore here…

Pulse Update: Sluggish harvest, quality concerns limit trade

A SLOW start to the southern harvest and variable quality to date is keeping traded volume to a minimum, while in the north, attention is turning towards planting of new-crop mungbeans.

Overall quality of lentils appears to be improving as harvest gathers pace, while the reverse could well be the case in faba beans.

Trade sources say economic uncertainty is impacting a number of counterparties spread from Egypt to Bangladesh as inflationary pressure and currency risk limit appetite for business on both sides.

New-crop trade in chickpeas is unusually thin for this time of year, with widespread downgrading of peas prevalent in most areas.

All prices quotes in Australian dollars.

Read more here…

South America

“Soybean dollar 2” working as planned for Argentine authorities

Argentina’s new version of the “Export Increase Program” (PIE) has resulted in US$ 1.824 billion worth of soybeans sold abroad, which nearly meets the government’s target, it was reported Friday in Buenos Aires.

The new PIE, also referred to as ”soybean dollar 2″ recognizes a parity of AR$ 230 for each US dollar, which in addition to a short supply amid growing global demand, has yielded positive results for the economic team headed by Superminister Sergio Massa.

On the first working day after the new soybean dollar, the price of the oilseed was quoted at AR$ 80,000 per ton which eventually became AR$ 100,000 per ton.

Soybeans on December 1 were trading at US$371 per ton, which with a dollar at AR$ 230 meant AR$ 85,330 per ton. One week later the value rose to US$430 and its peso equivalent with the PIE reached $98,900. A more than substantial improvement of US$ 59 per ton.

Read more here…

Fears of a record breaking global soybean harvest, and insufficient demand

Brazil is on track for a record-high Brazilian soybean harvest in the marketing year 2022-23 (January-December 2023), based on forecasts from commodity consultancies and government-owned institutions. The likely estimate means a looming oversupply expected to remain until at least mid-2023.

The average of estimates by the various organizations has the world’s top soy supplier producing a record 152 million tons of soybeans in MY 2022-23, up 20% year on year.

S&P Global Commodity Insights projects the Brazilian MY 2022-23 soybean crop at 150 million tons.

Substantial back-to-back supplies from the world’s top two soybean exporters (Brazil and US) are a recipe for a bearish 2023, they said. The US soybean new crop has been estimated at an average 118 million tons, and if Brazil’s record harvest projections are included, an oversupply seems likely.

The US Department of Agriculture has estimated the MY 2022-23 US soybean harvest at 118.3 million tons, close to its 5-year average of 118.4 million tons. Brazil and the US together account for 70% of global soybean production.

Read more here…

Argentine beef exports down for three months running, with prices dropping 20% since April

During October 2022, beef exports from Argentina fell for the third month running, dropping 3% in volume month-on-month, with sales revenue down 10.4%, according to Argentina’s Chamber of Meat Industry and Commerce (CICCRA).

So far exported volume dropped by 11.6% from the ceiling hit in July, whereas the price fell by 20% from the highest point in April.

In the tenth month of the year, the average price paid for each ton of beef sold by exporters was US$ 5,031 a ton, 10.4% below September values. On the other hand, China paid an average of US$ 4,252 per ton, down 8.7% less than in the previous month and 17.7% below May.

A similar scenario was experienced in Europe, which paid an average price 29% lower between April and October. On sales to US and Chile, since February prices dropped 31.4% and 15.0%, respectively.

Read more here

2022/23 Chilean Table Grape Export Forecast: Over Half From New Varieties

The Chilean Table Grape Committee of the Chilean Fruit Exporters Association (ASOEX) recently released its third forecast for the export volume of Chilean table grapes during the 2022/23 season. According to the report, Chile will export 66,920,661 boxes (8.2kg/box) of table grapes in the 2022/23 season, declining by 10% from the previous season. New varieties are expected to account for at least half of the total exports—a significant milestone for the Chilean table grape industry and a highlight of the season.

Speaking about the projected decrease in shipments ASOEX chairman Iván Marambio explained that it is an unavoidable consequence of the varietal replacement effort initiated a decade ago and indicates that the Chilean table grape industry is undergoing a profound transformation.

Exports of new varieties are forecasted to total 36,251,172 boxes, while exports of traditional varieties and the Red Globe variety are forecasted at 19,513,322 boxes and 11,156,167 boxes, respectively. Notably, the share of Red Globe grapes will wane further this season.

Read more here

Food Updates

The latest innovation helping to create a net zero food system

EIT Food’s Andy Zynga highlights the latest exciting innovation happening across the European food and beverage sector which is helping to shift the dial on the climate crisis.

With the inclusion of the first ever Food Systems Pavilion, the recent UN climate conference COP27 gave us both cause to celebrate and the momentum to push even harder to accelerate the transformation of our food system. There is an urgent need to halt global warming, and while the food system is a significant contributor to emissions, it also holds many of the solutions needed to tackle the climate crisis. Only by leveraging a diverse range of innovations will we be able to achieve a net zero food system which can sustainably feed our growing population for decades to come.

While we have known for several years that our global food system is responsible for at least one-third of greenhouse gas emissions, a study published in 2021 revealed that between one-fifth and one-quarter of anthropogenic emissions are generated by on-farm production and related land-use change.1

Read more here

Food manufacturers struggle to prioritise sustainability

Research carried out by Tetra Pak has revealed that, across the UK and Ireland, 93 percent of the surveyed food producers and manufactures have admitted that “sustainability is no longer a priority”.

Although 36 percent of respondents said that they considered the pursuit of sustainable practises to be important, a further 36 percent claimed that other factors will take the lead in the next 12-24 months.

However, as a form of self-reflection, 70 percent said that they believed their organisation should be doing more to address sustainability issues.

Read more here…

Have researchers found a way to make cultured meat cheaper?

Cultured meat is expensive to produce, but researchers claim they might have found a way to make its production more cost-effective.

Cultured meat has taken vast strides towards widespread consumption in recent weeks, especially with the FDA’s “No Questions” letter being received by UPSIDE Foods in November 2022.

Yet significant barriers, most obviously relating to production costs, still remain in place before cultured meat gets onto supermarket shelves around the world.

But now, researchers from Singapore and China have found a way to use food waste for culturing meat, which could reduce production costs and perhaps make cultured meat a viable option for feeding the world’s population.

To produce cultured meat, animal muscle stem cells are grown on a scaffold which improves the environment for the cells by enabling the transport of nutrients and allows the generation of texture and structure. Without it, the meat is more likely to resemble lumpy mashed potatoes.

Read more here…

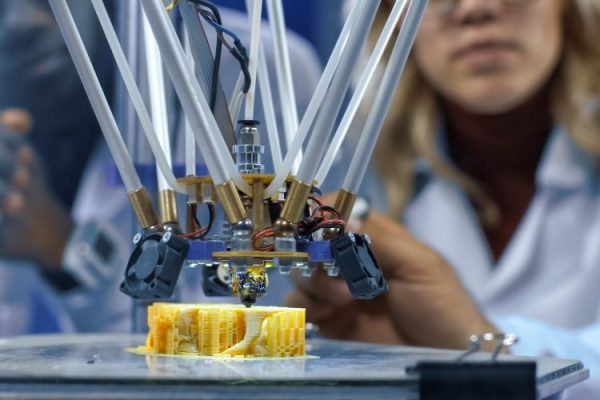

UK agriculture and robotics receive £12.5 million funding

DEFRA has committed to further funding for agriculture and horticulture automation and robotics to improve productivity.

Ahead of its January launch, the Department for Environment, Food and Rural Affairs (DEFRA) has published guidance for the third round of the Farming Futures Research and Development Fund competition which focuses on agriculture and robotics.

In order to boost productivity and sustainable farming practises via the development of automation and robotic technologies on farms, DEFRA will be match-funding projects in partnership with UK Research and Innovation (UKRI).

“This is an exciting opportunity for farmers and growers to come together with businesses and researchers to invent ingenious solutions to the problems our agriculture and horticulture sectors face,” said Mark Spencer, Farming Minister for DEFRA.

Read more here…