USA and Canada

Predict your yields for 2022

The western Canadian agricultural industry saw a brutal year in 2021. It was frustrating to have record prices for grain and then have Mother Nature turn on us and not provide the wherewithal to produce crops to take advantage of them.

With many crops yielding much below half of what is considered average in any area, salt was rubbed into farmers’ wounds when they had to buy out contracts they had signed at attractive prices, but were unable to deliver.

I have been asked several times this fall to describe how to accurately predict yields to try and avoid a repeat of last year’s circumstances. Because so much of the factors that go into yield are the result of Mother Nature’s graces — good and bad, predicting yield is next to impossible. However, there are things you can do, using averages, that may enable you to get a better picture of what to expect next year.

Read More…

Dry conditions threaten U.S. winter wheat crop

The U.S. winter wheat crop is heading into dormancy in the second worst condition of this century.

The U.S. Department of Agriculture reports that 23 percent of the crop was in poor to very poor shape as of the end of November.

It is the lowest rating for that period since 2012.

“Across portions of the Great Plains and Northwest, establishment of the wheat crop has been hampered by lack of topsoil moisture,” the USDA said in its last crop condition report for the calendar year.

DTN ag meteorologist emeritus Bryce Anderson said seasonal forecasts suggest some improvement for the Northwest in 2022 with above-normal precipitation forecast for the winter and early spring.

Read More

The Race for Organic

Once a small piece of the food pie, organic foods are going mainstream and jumping into more row crop fields. Organic products are now available in nearly 20,000 natural food stores and nearly 3 out of 4 conventional grocery stores, according to USDA.

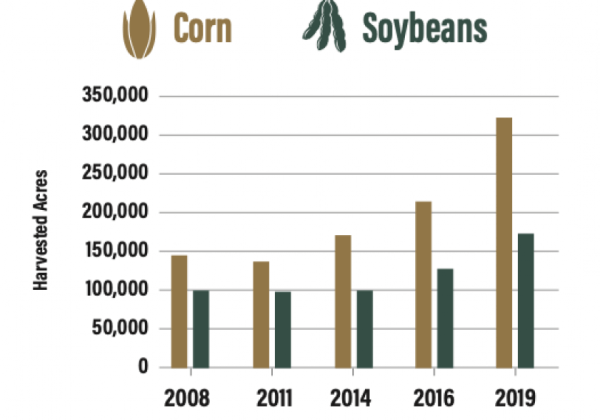

From 2008 to 2019, harvested acreage of organic corn increased 124% while acreage for organic soybeans rose 73%, according to USDA. Despite the upward trend, the organic share of total domestic corn and soybean acreage accounted for less than 1% of total harvested acres for each crop in 2019.

This growth is not surprising to David Ross, sales and operations manager for Great Harvest Organics, a division of Beck’s Hybrids. He has seen demand for organic corn and soybean seed grow as farmers look to diversify their row crop lineup or reduce their use of synthetic chemicals or fertilizers.

Read More

2022 Outlook: Why Corn’s Sweet Spot May Be Below $6 in the New Year

Corn prices have been on a volatile ride in 2021. Since the beginning of January to today, the December 2021 corn contract rose 34.5%. With a high of $6.36 ½ set on May 7, prices have continued to bounce across the board in a range of more than $1.

As analysts turn their attention to next year, which is creating more of a bullish outlook: corn or soybeans? The answer is mixed, but even with a tapered expectation of corn exports in the New Year, analysts are more optimistic when it comes to the price picture for corn.

“I’m a little bit softer on export demand. China has a lot of corn on the books, but they’re not taking shipment of it. That’s a concern until they start to do so that can always be rolled into the next year,” says Arlan Suderman of StoneX Group.

Despite the concern over the current status of corn exports, AgriTalk Host Chip Flory says corn seems to be finding true demand. He says total corn demand this year was estimated up slightly from last year in USDA’s November Supply and Demand Report.

South American weather and strong exports push soybeans ahead

AgweekTV’s Michelle Rook and Randy Martinson of Martinson Ag Risk Management discuss a big week for soybeans and an expected slow down in trade heading into the holidays.

After news of some “nuisance rains over recent weeks,” South America is looking at some warm, dry conditions, Randy Martinson of Martinson Ag Risk Management says. That, combined with some recent export purchases, pushed soybeans ahead in the U.S. on Friday.

“We did see China come in and make some purchases,” he said on this week’s Agweek Market Wrap with AgweekTV’s Michelle Rook. India also made some soybean oil purchases, he noted.

Soybean meal has been the big leader of the soybean sector as of late, Rook pointed out.

“That really has captured the market as of late,” Martinson said. “It’s the leader of the products.”

Read more…

New Zealand

Food and Fibre exports forecast to exceed $50b to hit a new record, MPI says

Food and fibre sector exports are expected to exceed $50 billion in annual revenue for the first time as demand for the country’s primary products pushes up prices.

The export value is expected to rise 6 per cent to $50.8b in the year to June 30 2022, according to the Ministry for Primary Industries’ Situation and Outlook for Primary Industries report released on Wednesday.

That’s an improvement from the year to the end of June 2021 when primary sector exports slipped 1 per cent to $47.7b as the Covid-19 pandemic disrupted markets.

Read More here…

Value of meat exports surges

The value of New Zealand’s red meat sector exports reached $693 million during October, a 27 per cent increase year-on-year, the Meat Industry Association (MIA) says.

The major sheep meat markets by value were China, up 25 per cent to $131m, the United States, up 54 per cent to $46m, and the Netherlands, up 94 per cent to $29m.

Overall, the value of China’s imports of New Zealand red meat was up 34 per cent to $262m, the United States by 47 per cent to $138m, Japan by 29 per cent to $31m and the Netherlands by 76 per cent to $30m.

Sirma Karapeeva, chief executive of the association, said that strong global demand for protein and strong global prices, especially from China, as it addressed the increased demand due to African Swine Fever, contributed to the increase in export value.

Read More here…

Farmer confidence unchanged from last quarter with an even split expecting expecting improvement and worsening, but dairy farmers much more positive, others more pessimistic

New Zealand farmer confidence continues to ‘hang in the balance’ as 2021 concludes, with an even split of farmers expecting the performance of the agricultural economy to improve in the year ahead and those expecting it to worsen.

The fourth and final Rabobank Rural Confidence Survey of the year — completed late last month — found net farmer confidence relatively unchanged from last quarter, inching fractionally higher to + one per cent, up from the net zero reading recorded in September.

The survey found the number of farmers expecting conditions in the agricultural economy to improve in the coming 12 months had risen to 28 per cent (up from 23 per cent last quarter) while there were also more farmers expecting conditions to worsen (27 per cent from 23 per cent previously). The number of farmers expecting the performance of the agricultural economy to stay the same fell to 43 per cent (from 52 per cent previously).

Read More here

Allan Barber assesses the financial health of the red meat sector by running his rule over a declining set of public annual reports. Alliance Group is the latest one, and it shows an improving trend

The Alliance Group posted a significantly better result for the 2021 year, achieving a 53% improvement on the previous year at the pre-tax and provisions level. The latest result incurred a much reduced provision for historical employee entitlements, enabling the company to report a post-tax profit of $23.8 million after distributing $8.5m to shareholders compared with $7m after tax in 2020 with no distribution.

Total revenue was only marginally up, but key differences were an improved operating margin between revenue and cost of sales, partly offset by an increase in administrative expenses, and an improvement of nearly $10m in equity accounted earnings. This last item suggests a massive performance improvement by the North American Lamb Company associates which will also show up in joint shareholders Silver Fern Farms’ and ANZCO’s annual results. This category also includes other partly owned businesses such as pet food ingredient supplier Meateor.

Three cheers as cherry harvest kicks off in Tasman orchard

A local cherry orchard has kicked off their summer harvest, with owners saying they had the strongest start they’ve ever had.

Ruby Bay Cherries owners Neil and Wanessa Hoggarth started their harvest season on Monday.

And while other cherry orchards in the top of the south were having a difficult summer, Neil said Ruby Bay Cherries had the best first day of the season they had ever had.

The crop was lighter, Neil said, but the fruit was bigger, and was delicious.

This year, the orchard was doing an initiative where for each 2kg box of cherries that was purchased using a school discount code, Ruby Bay Cherries would donate $5 back to the school.

This was the first year they had done this, Neil said.

“$5 back from each box goes straight to local schools.”

Australia

World awash with grain

The global wheat outlook for 2021-22 is for higher supplies, greater consumption, increased trade and higher ending stocks in the 2021-22 marketing year, according to the latest World Agricultural Supply and Demand Estimates (WASDE).

On the whole, this month’s report from the US Department of Agriculture (USDA) provided very little fodder for the wheat bulls, and the futures market was sold down accordingly.

Last Thursday’s Chicago Board of Trade (CBOT) session saw the benchmark December 2021 futures contract close down 17.75 cents per bushel (c/bu) at 773.5c/bu, which was equivalent to $396/tonne.

The contract did recover almost half of that loss in Friday’s trade, going into the weekend at 782c/bu, or almost $401/t, after the dust quickly settled on the WASDE report.

Read more here…

Summer croppers hope rain positives outweigh negatives

FLOODS have damaged summer crops in northern NSW and southern Queensland but there is some cautious optimism the damage may not be as severe as first thought.

“We’ve definitely seen some bad losses on irrigated cotton on the Macintyre and Dumaresq Rivers where they just couldn’t keep the water out of the paddocks,” said grains section president of AgForce, Queensland’s peak farmer group, Brendan Taylor.

“However there are also patches where farmers are getting back out and finding that plants are still alive, both in cotton and sorghum,” he said.

“We’ve had a run of nice warm weather and sunny days and things have dried out, so if the crops weren’t flooded out they’ve got plenty of moisture to access and yield potential is actually really good.

“It’s the old saying with floods, there is some really severe damage for some but the moisture often is a real positive for others.”

Read more here…

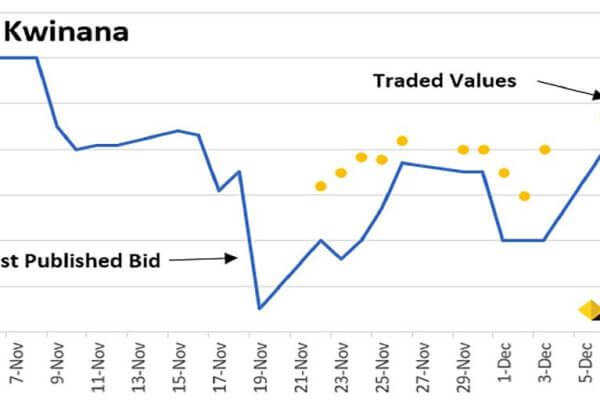

Grain prices ease back but still at harvest records

GRAIN prices have continued to drop over the past week as a combination of local harvest pressure and international data supportive of a fall in values take the edge of the market.

All up ASX APW wheat futures have now fallen a substantial $57 a tonne from their end of November highs to sit at around $377/t for the January 2022 contract.

Cash prices have moved in a similar direction, with APW cash prices delivered port this week sitting at around $380/t east coast and SA and $370/t WA.

Canola has well and truly come back from its time above $1000/t to be around $850/t port in most regions.

After spending some time looking relatively globally expensive, Australian wheat in most port zones is once again strong competitive against rival origins.

Read more here

GrainCorp records busiest week of harvest in weekly update

A BREAK in wet conditions has paved the way for GrainCorp to record its busiest week of harvest across the eastern states this year.

More than one million tonnes of grain made its way into receivals across NSW, Victoria and Queensland this past week, taking the overall total to more than eight million tonnes for the season.

NSW accounted for the majority of this week’s deliveries with 1,083,380 tonnes reaching GrainCorp sites across the state, taking NSW’s overall total to 4,591,230 tonnes.

Dubbo, Wyalong and Griffith were among NSW’s busiest sites during the past week.

Harvest operations in Victoria are progressing as sites across the state recorded a bump in activity during the past week, especially across the north east of the state and the Wimmera regions, including very strong canola deliveries.

Read more here…

Growers have grain pricing power

THE reality is Australian growers have likely never before had this much pricing power in global grain markets.

Yet prices bid to growers have never been this far discounted when compared to global values.

That’s the market scenario in which we find ourselves.

The world needs Australian grain because they can’t get it readily from elsewhere in the world, due to production issues over the past year.

This is not likely to change until the northern hemisphere crops become available which for the majority is the middle of next year.

This means Australian grain is setting the global price.

Read more here…

South America

China lifts ban on Brazilian beef, but UK and EU retailers will stop purchases because of deforestation

Good and bad news for Brazil’s beef exports. China finally lifted the ban on Brazilian beef and allowed the resumption of shipments to the great Asian market. But several of the main retailers in Britain and the European Union have announced the banning of Brazilian beef in their shelves because meat processors are using cattle linked to the Amazon and Pantanal deforestation.

China’s ban lifted on Wednesday lasted since 4 September when two atypical cases of mad cow disease were reported in the states of Minas Gerais and Matto Grosso. Chinese Customs informed the Brazilian government that shipments of boneless beef products from cattle under 30 months of age, are again allowed in the market.

The secretary of Commerce and International Relations from the Brazilian Ministry of Agriculture, Orlando Ribeiro, stated that the resumption is “total” and “without additional conditions”. Ribeiro added that “everything certified after December 15th will be accepted”

Read More here…

Argentina exchange says dry summer poses ‘big challenge’ for soybeans, corn

BUENOS AIRES, Dec 14 (Reuters) – Argentina’s weather outlook poses a “big challenge” for soybean and corn production, with lower-than-normal rainfall due to the La Niña climate pattern expected during the region’s summer, the Buenos Aires grains exchange said.

Argentina is the world’s leading exporter of processed soybeans and the second-largest exporter of corn. Farmers are currently sowing soy and corn for the 2021/22 season.

“We are facing a climatic scenario … that poses strong challenges to production,” the exchange said in its monthly climate report posted late on Monday, adding that “the return of the rains could be delayed until mid-March”.

“One of the most damaging effects caused by ‘La Niña’ in the Pampeana Region (the central farming area) and adjacent areas, is to extend the seasonal drought, which normally takes place during January,” it said.

Read more here

Argentina limits grain exports in fight against food inflation

Argentina is putting a ceiling on exports of corn and wheat in a fresh bid by the Peronist government to quell food inflation at home.

The government will first decide how much of the grains are needed in Argentina, and then proceed to stop exporters from registering shipments that’d jeopardise those domestic supplies, according to a resolution published on its website Friday.

“It’s a resolution that the food industry considers necessary to provide predictability,” Agriculture Minister Julián Domínguez said in a statement. “And to safeguard what Argentines need for their own consumption.”

Argentina is the world’s third-biggest corn exporter and a top supplier of wheat, so any change to exports may have broader implications for global agriculture markets when supply chain snags have disrupted transport and food prices around the world have soared.

Read More here…

Season’s First Sea Shipment of Chilean Cherries Arrives in Hong Kong

After 23 days at sea, the “Cherry Express” freighter Cochrane reached Hong Kong in the early hours of Dec. 12 as anticipated.

The ship’s cargo was the first seaborne shipment of Chilean cherries to arrive in Hong Kong this season and comprised a total of 54 containers of cherries, of which the main varieties were Santina (28 containers) and Royal Dawn (19.8 containers). In addition, the shipment also contained smaller quantities of other varieties, including Royal Hazel, Royal Lynn, Frisco and Bing. The shipment included cherries of sizes XL, J, 2J and 3J. According to the cherry export quality guide published by the Chilean Cherry Committee of the Chilean Fruit Exporters Association (ASOEX), as of Dec. 1, 2021, the smallest size that can now be exported to China is XL, meaning that cherries of size L and below will no longer be sent to the China market.

On the same evening that the new shipment arrived, Guangzhou’s Jiangnan Fruit and Vegetable Wholesale Market was buzzing in anticipation, with everyone eagerly awaiting the opening of the first container of cherries.

Read more here…

Food Updates

What you eat affects taste preference, according to new study

A new study from scientists in California has suggested that a diet high in protein increases preference for carbohydrates, and vice versa.

What you eat influences your taste for what you might want to eat next. That’s according to a University of California, Riverside study performed on fruit flies.

The study, published in the Journal of Neuroscience, offers a better understanding of neurophysiological plasticity of the taste system in flies.

To maintain ideal health, animals require a balanced diet with optimum amounts of different nutrients. Macronutrients like carbohydrates and proteins are essential; indeed, an unbalanced intake of these nutrients can be detrimental to health.

New study finds blueberries could be good for your heart

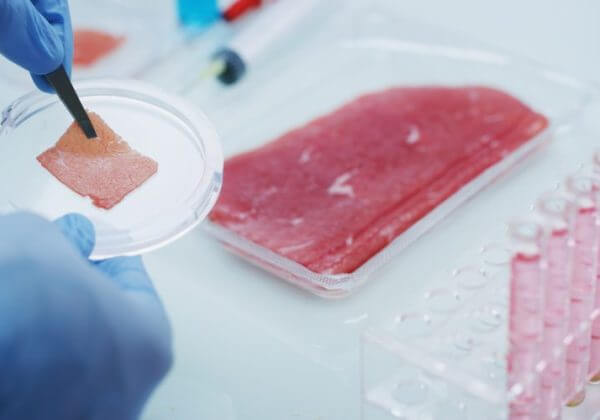

Lab-grown meat’s commercial future

Read more here…

New-age agriculture

With the global population on course to be 9.9 billion by 2050 and the ever-more intense race to reach Net Zero, our methods of food production need a drastic rethink. Will technology be our saviour?

Old Macdonald had a farm E.I.E.I.O, and on his farm he had an autonomous tractor which maps the entire field and collects data…Not as catchy as the original, I’ll admit, but certainly a more accurate depiction of what the future farm may look like.

As the population grows and we struggle with harsher climates and pesticide-resistant plants, growers have had to take a step back to jump several forward. Artificial intelligence (AI), automation, gene editing (GE) and indoor farming – concepts that were once the tales of science fiction – now hold the future of our food system in their hands.

Fifty percent of global topsoil has been lost by intensive farming.1

Read more here…

What’s in store for food in 2022?

Prediction one

It doesn’t take much reading to understand the price pressures on food will continue through much of next year. The impacts of Brexit and Covid will take most of the blame, but the ongoing and worsening climate crisis will increasingly impact food prices and food availability too. We will see more evidence of the negative impacts of droughts, floods, wildfires and heatwaves. This in turn will require greater focus on the additional use of legal and illegal pesticides, which may well occur as many farmers worldwide struggle to deal with increased attacks from pests due to climate change.

Read more here…