USA and Canada

U.S.-Mexico corn fight could hurt barley growers

A brewing corn trade war between Mexico and the United States could have dire consequences for Canadian barley growers, says an analyst.

Mexican president Andres Manuel Lopez Obrador issued a presidential decree on Dec. 31, 2020, that would ban the import of genetically modified corn starting in 2024 and phase out the use of glyphosate.

On Nov. 28, 2022, the United States threatened legal action against Mexico if it proceeds with that plan.

“The president’s phase-out decree has the potential to substantially disrupt trade, harm farmers on both sides of the border and significantly increase costs for Mexican farmers,” U.S. Secretary of Agriculture Tom Vilsack said in a tweet after meeting with Lopez Obrador.

Read More…

U.S. winter wheat crop in trouble

The U.S. winter wheat crop is in terrible shape as 2022 draws to a close, but that is not necessarily a precursor of what’s to come in 2023, says an analyst.

An estimated 34 percent of the crop was rated good-to-excellent as of Nov. 29, down from 44 percent the same time one year ago.

It is the second worst score dating back to 1987 for this time of year.

The poor rating stems from that fact that there is still extreme to exceptional drought in much of the central and southern Plains regions of the U.S.

Aaron Harries, vice-president of research and operations with Kansas Wheat, said the U.S. Department of Agriculture’s poor crop ratings are accurate.

“If anything, the conditions are going downhill,” he said.

Read More…

U.S. farm incomes seen soaring to new highs on global food, feed demand

CHICAGO, Dec 1 (Reuters) – Soaring grain and livestock prices are expected to push U.S. farm incomes to a historic high this year, as producers benefit from strong global grain and oilseed demand amid tight supplies, the U.S. Department of Agriculture reported on Thursday.

Net farm income — which is a broad measure of profits in the agricultural economy, according to the agency — is forecast to increase to $160.5 billion in 2022 from $19.5 billion a year earlier.

Much of the growth in the crop sector came from sales of corn, soybeans and wheat, the agency said, noting that livestock cash sales receipts were also expected to jump nearly 31% to $256.0 billion.

In inflation-adjusted 2022 dollars, net farm income would be at its highest level since 1973 and net cash farm income at its highest level on record, the agency said.

Read More …

Canadian wheat, canola harvests turn out smaller than expected due to dryness

Canada’s wheat and canola harvests turned out smaller than expected due to dry conditions in parts of the Prairies, but were still bigger than last year’s, a government report showed on Friday.

War in Ukraine has tightened global supplies of wheat and vegetable oil, of which Canada is a major producer. Dry conditions in Argentina have further inflamed food security concerns.

Canada, however, produced its third-biggest wheat crop ever, bouncing back from last year’s severe drought.

Statistics Canada estimated all-wheat production at 33.8 million tonnes, down from its September estimate of 34.7 million but still 52 per cent higher than last year.

Read more…

New Zealand

Growers building accommodation, bumping up wages in bid for workers in Eastern Bay of Plenty

Growers desperate for workers are building their own accommodation, bumping up wages, and trying to recruit backpackers before they arrive in the country.

A handful of Eastern Bay of Plenty primary industry employers turned out to meet with National party immigration spokeswoman Erica Stanford at a Te Rahu Road kiwifruit orchard in late November.

Stanford was there to hear about some of the issues facing orchardists and farmers due to worker shortages in New Zealand, particularly RSE (Recognised Seasonal Employer) workers and working holiday makers.

“We’re working on an immigration policy at the moment so I’m talking to people and making sure that we are on the right track, hearing their stories.”

Read More here...

Lincoln University releases information about the way climate change may affect farming locations and type of production, and how farmers can respond, in a Westpac-supported report

Westpac NZ and Lincoln University have released research that finds agile farm management will be critical in reducing emissions and adapting to climate change.

Authored by Lincoln University’s Agribusiness and Economics Research Unit on behalf of Westpac, The Westpac NZ Agribusiness Climate Change Report assesses the risks and opportunities presented by climate change, as well as the sector’s vulnerabilities and potential responses.

Westpac NZ Head of Agribusiness Tim Henshaw says the report and a series of factsheets were designed to provide Westpac customers and other farmers and growers with impartial information about the way climate change may affect their location and type of production, and how they can respond.

Read More here…

Kiwifruit orchard ‘set back three years’ after vines cut

Police in the Eastern Bay of Plenty town of Te Teko have appealed for information from the public after a kiwifruit orchard was targeted and vines were cut.

The damage saw 150 gold kiwifruit vines cut sometime between November 24-26.

The authorities suggested it would be three years before the vines could be harvested once more.

“This is a mindless act,” said Te Teko rural liaison officer, constable Wayne Lawrence.

“It has not only caused the victim a financial loss, but also a considerable amount of emotional harm.”

Constable Lawrence added that the damage caused to the vines has set the orchard back three years.

“The financial cost through loss of income and ongoing cost to repair the vines is also extremely high, to the point where the victim may never recoup what has been lost,” he said.

Read More here…

Exorbitant tariffs, import barriers and protectionism: what’s holding back our trade in Asia

Walking around the Indian capital of New Delhi as part of a recent business delegation, Sirma Karapeeva was astounded to see how many people were dining out at high-end restaurants.

As the head of the Meat Industry Association in New Zealand, representing the country’s second-largest commodity export, Karapeeva just wishes they had more of our meat on their menus.

“They were out and about eating in top-notch restaurants and spending up, so clearly there’s a lot of opportunity there, but it’s an area that we haven’t been able to crack,” she says. “It is very much in our scope and very much in our line of sight as a priority market.”

India is Asia’s third-largest economy after China and Japan, but only 19th in New Zealand’s list of most valuable meat export markets in Asia, taking just $1.6 million of the country’s meat, mostly sheep, in the year to the end of August compared with China’s $3.85 billion and Japan’s $531m.

Read More here…

Australia

GrainCorp harvest intake rockets to 4.6Mt

EASTERN Australian bulk handler GrainCorp has received 4.6 million tonnes (Mt) in the harvest to today following a 1.57Mt intake in the past week, it said in its latest Harvest Update.

The update said harvest has finished in Central Queensland, with many growers enjoying record yields in the biggest harvest they have seen in more than a decade.

The focus is now on southern Queensland, with the majority of receivals coming from the Goondiwindi region.

Northern New South Wales sites are well into harvest now, with the majority of receivals coming from Moree, Dubbo and Burren Junction regions.

Canola deliveries have been strong, with the cool, wet spring bringing in good yields and oil levels.

Read more here

Wet harvest sees malt premiums counter China’s absence

THE PREMIUM for malting barley over feed has surged to reflect the wet end to the growing season in south-eastern Australia, and pull the market out of the doldrums seen since China imposed a trade-halting tariff on the Australian grain in 2019.

Speaking at the Australian Export Grain Innovation Centre (AEGIC) webinar on Thursday, it was one of the key messages to come through from three leading barley growers, and also from Ag Scientia analyst Lloyd George.

The webinar was the latest event hosted by AEGIC to keep Chinese maltsters and brewers in touch with Australia, which exported up to 3.5 million tonnes (Mt) per annum of malting barley to China prior to tariff introductions in 2019.

Entitled Quality of Australian malting barley: From producer to consumer, the webinar was held in the wake of what appears to be some diplomatic headway being made between the Chinese and Australian governments after a troubled few years.

Read more here …

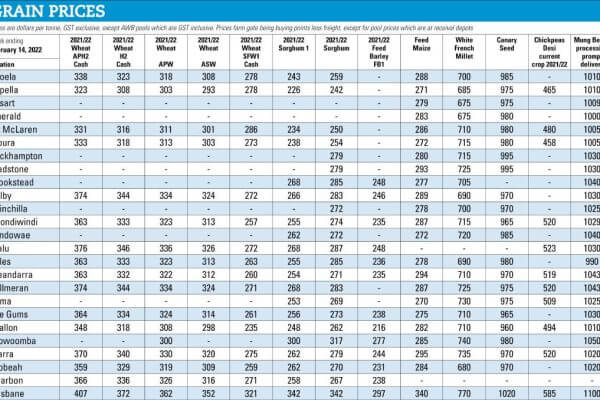

Feedgrain Focus: Southern prices feel harvest pressure

A CHARGE on harvest in New South Wales under mostly clear skies has seen a flurry of selling activity in the past week that has enabled most consumers to get covered into the New Year.

The Victorian harvest has also cranked up, and to everyone’s delight, rainfall recorded for both states in growing areas in the week to today has been minimal at most.

In the north, feed barley is in demand, and an unusually high proportion of malting has tightened supply in the near term.

Queensland rain welcome

Queensland’s growing areas have had significant rain which is good news for summer crops in the ground, or area about to be planted, now that the winter-crop harvest is just about finished.

In the 24 hours to 9am today, registrations include: Clermont 17 millimetres; Dalby 15mm; Emerald and Springsure 48mm; Miles 40mm; Roma 20mm, and Surat 43mm.

Read mpore here…

Records fall as CBH receives 3.4Mt for week

WESTERN Australian bulk handler CBH Group received 3.4 million tonnes (Mt) of grain in the week to today to bring its 2022-23 intake for the harvest to date to 10.35Mt, the co-operative said in its latest Harvest Report.

CBH Group chief operations officer Mick Daw said the past week had been extremely busy across the network, with several sites breaking receival records.

“With growers finally experiencing decent harvesting conditions combined with exceptional yields, we have seen 22 sites break daily receival records.”

“On Thursday 1 December 2022, we broke the daily receival record with 587,974 tonnes received across the network, marginally surpassing the previous record of 587,738t which was set on the same day last year,” Mr Daw aid.

Read more here…

South America

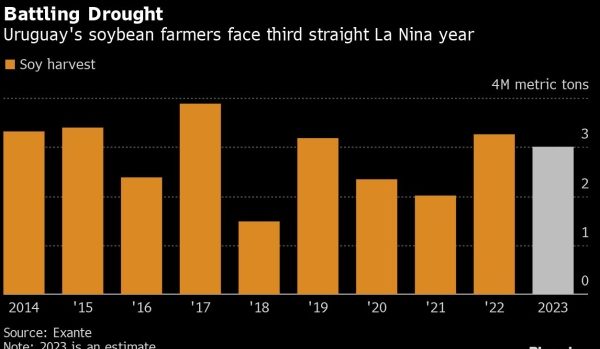

Argentine exchange says early soy in core farm belt hit by drought

BUENOS AIRES — Prolonged drought has left over a third of early planted soybeans in Argentina’s core farming region in regular to poor condition, the Rosario grains exchange said, adding more dry and hot weather was expected in the days ahead.

Argentina is the world’s leading exporter of processed soybean oil and meal, but an ongoing drought in the Pampas plains is causing challenges for the start of the 2022/23 soybean season, with planting ongoing.

Drought has already caused significant losses in wheat crops in the same cycle and caused major delays to soybean planting.

The Rosario exchange added that for the first week of December, above normal temperatures and a continued lack of rainfall are expected, bad news for the early planted soy that’s already suffering.

“A lack of water and high temperatures in recent weeks left numerous soybean fields in critical condition. Most of these fields are located in the east and southwest,” said the exchange, which noted that 4.1 million hectares of early soybeans have been planted so far in the area.

Read more here…

Chile targets Brazil to promote and expand exports

Chile is renewing its strategy to increase and diversify exports to the largest economy and market in South America. Spearheaded by ProChile, an arm of the country’s Ministry of Foreign Affairs, the plan is to expand its network in Brazil with new offices in Brasília and Belo Horizonte.

The strategy includes strengthening digital avenues to increase trade and market events to promote an export basket that ranges from olive oil to pork, onion, garlic and the classic wines item.

However the goal of diversifying exports will not make ProChile lose track of the country’s flagship in Brazil. Salmon and trout sales, which currently lead the list, generated US$ 673 million between January and October, up 12.4% from the same period last year.

In terms of agribusiness exports, Brazil is Chile’s third-largest export destination. The US leads with US$ 5.4 billion in the first ten months of this year, representing a growth of 29.9%, according to data from ProChile.

Wines, another Chilean export to Brazil, sales increased 4,5% to US$ 159 million in the first ten months of the year, with a jump in purchases of sparkling wines, a modest demand until this year.

Read more here…

SOYBEAN SALES IN ARGENTINA HAVE THE HIGHEST LEVEL IN MONTHS WITH RESUMPTION OF PREFERENTIAL EXCHANGE RATE

Argentine farmers sold 299 thousand tons of Soy on Monday, the highest volume of the last two months, thanks to the exchange that the government established for the rest of the year to try to speed up the inflow of foreign currency into the country, informed this Tuesday the Rosario Stock Exchange (BCR).

Argentina, the world’s largest exporter of soybean oil and meal, has been selling its soybeans since Monday at an exchange rate of 230 pesos per dollar38% higher than the interbank rate that governed the market on Tuesday, which encouraged operations.

Soy complex exports are the main source of foreign exchange for the South American country, whose central bank is trying to bolster its foreign currency holdings, which have fallen sharply on uncertainty over the local currency amid high inflation and financial adversity.

Read more here

Chile Launches 2022/23 Fresh Fruit Export Season Despite Delays

On Nov. 22, Chile’s 2022/23 fresh fruit export season was launched at the Port of Valparaíso, one of the most important export ports in Chile and Pacific South America. Attendees including Esteban Valenzuela, Minister of Agriculture, Iván Marambio, chairman of the Chilean Fruit Exporters Association (ASOEX), and Andrea Collao, national director of Chile’s Agricultural and Livestock Service (SAG), among other distinguished public and industry officials, placed great emphasis on improvements made this season to avoid the logistical challenges of a year ago.

Based on a recently launched collaborative logistics plan, government and industry have implemented a series of measures to improve the logistics chain and retain fruit condition and quality. Among these measures are new departure ports closer to production areas such as the ports of Coronel and Ventanas, optimization of the logistics chain from ports to the rest of the country, and improvements to the key ports of Valparaíso and San Antonio.

In particular, the Port of Valparaíso has increased its electrical infrastructure, implemented an export cargo scheduling platform, expanded cargo loading and reception and, from January to April 2023, extended sanitary inspection services.

Read more here

Food Updates

FSA pilots School Food Standards compliance

A total of 18 local authorities across England are participating in the School Food Standards compliance pilot created by the Food Standards Agency (FSA) and Department for Education (DfE).

This pilot has been set up to understand whether schools across England are adhering to the School Food Standards that exist to make sure children are being nutritiously fed during school hours.

“We all want to ensure that the food served in schools meets the standards that have been set,” said Professor Susan Jebb, FSA Chair.

“This project will give insight into what’s happening in schools today and identify whether additional support is needed to help them to do the very best they can for children and drive positive change in the school food system.”

“This project will give insight into what’s happening in schools today and identify whether additional support is needed to help them to do the very best they can for children and drive positive change in the school food system.”

Read more here

Sports beverages: “Finding your niche”

What are functional beverages?

Functional beverages are non-alcoholic drinks that serve a purpose. According to an academic study, they typically contain ingredients such as minerals, vitamins, amino acids, dietary fibres, probiotics and added raw fruits.

Read more here…

Brexit has cost UK households £5.8 billion in higher food bills

According to research, leaving the European Union (EU) added an average of £210 to household food bills over the two years leading up to the end of 2021, with Brexit ultimately costing UK consumers a total of £5.8 billion.

The study titled ‘Non-tariff barriers and consumer prices: Evidence from Brexit’ was carried out by the London School of Economics’ (LSE) Centre for Economic Performance (CEP).

According to the CEP, overall food prices increased by six percent, however it also revealed that the these increases had a “proportionately greater impact on the poorest people”. Researchers noted that this is because low-income households spend a greater share of their income on food than richer families.

Specifically, the poorest households were affected by a Brexit-induced 1.1 percent rise in the overall cost-of-living whereas the top 10 percent of households were reportedly only subject to a 0.7 percent price rise.

Read more here…

“Christmas cheer will be dampened” by food inflation

The BRC has forecasted an “increasingly bleak” winter with food inflation increasing to 12.4 percent in November.

According to the British Retail Consortium (BRC), food inflation is on the rise again as in November 2022 it soared to 12.4 percent compared to October’s 11.6 percent.

According to Helen Dickinson OBE, Chief Executive of the BRC, the prices of meat, eggs and dairy have been “hit by rocketing energy costs, and the rising costs of animal feed and transport”.

Additionally, Dickinson noted: “Coffee prices also shot up on last month as high input costs filtered through to price tags.”

Shop price annual inflation reportedly accelerated to 7.4 percent in November (up by 1.2 percent from 6.6 percent in October 2022). According to the BRC, this marks another record for shop price inflation since the index started in 2005.

Read more here…

“The canola took that heat spell, that heat wave pretty tough and so the crops looked really good but final yields were a little bit off from what we were hoping for,” added McKee.

“The canola took that heat spell, that heat wave pretty tough and so the crops looked really good but final yields were a little bit off from what we were hoping for,” added McKee.