USA and Canada

U.S. raises estimates for corn, soybean yields and inventories

CHICAGO, Nov 9 (Reuters) – U.S. corn and soybean inventories will be bigger than previously thought as yields of both crops increased from earlier estimates, the government said on Wednesday, Nov. 9.

Bigger-than-expected harvests give a slight boost to U.S. supplies at a time global grain inventories are low following Russia’s invasion of Ukraine. U.S. corn stocks will remain at a 10-year-low after dry weather hurt production

“Typically small crops get smaller but USDA went the other way and took the yield up on corn and soybeans,” said Don Roose, president of brokerage U.S. Commodities in Iowa. “Some of it was probably a good end to the harvest so field loss was probably less.”

Corn and soybean futures were weak at the Chicago Board of Trade.

Read More…

U.S. hard red spring wheat farmers produce good, marketable crop, but export demand is lackluster

MINOT, N.D. — The 2022 hard red spring crop yielded well, was disease free and, overall, will be a good crop to market, said Erica Olson, North Dakota Wheat Commission market developer and researcher manager.

Olson gave an overview of 2022 hard, red spring wheat production at the Crop Outlook and International Durum Forum annual meeting held Nov. 2-3 in Minot, N.D.

The number of hard red spring wheat acres planted in the northern Plains and Montana in 2022 decreased by 5% because of cold, wet weather conditions in the spring, but the number of harvested acres increased by 2% over 2021, Olson said. In 2021, hard, red, spring wheat farmers in drought areas abandoned drought-impacted acreage because they didn’t believe it was worth harvesting the crop, she said.

Read More…

Crop damaging pests, disease and weed found in northeast North Dakota in 2022

LANGDON, N.D. — Diseases, an insect and a weed, all which have the potential to cause severe crop losses showed up — some for the first time — in northeast North Dakota fields during the 2022 growing season.

Hessian fly, an insect, was found in Cavalier County wheat fields, there was a waterhemp infestation in a field in Cavalier County, Verticillium wilt was suspected in fields in Cavalier, Pembina and Rolette counties, and sudden death syndrome, a fungus, was confirmed in Cavalier County soybean fields.

Sudden death syndrome, caused by the fusarium fungus, is a soilborne disease that once is in the soil, stays there, said Anitha Chirumamilla, Langdon Research Extension Center cropping systems specialist.

Read More …

Beyond sustainability on the farm

Sustainability has been a hot topic in agriculture for years, but at GFL Ag, we see beyond that. Growers are not only trying to sustain the farming activities on their farms, but to improve the land and resources available to ensure the farm’s longevity. New and innovative agricultural practices and products are needed to pave the way forward.

Generations of agricultural families have instilled the value of making the most of what’s available to you – whether that be seed, crop inputs or livestock feed. In the creation of our product Bio-Sul Premium Plus, we use two readily available ingredients (compost and elemental sulphur) with limited applications to make an effective and affordable crop input for growers.

In 2019, 87 per cent of Canadians with access to municipal composting or organics collection programs used them – contributing to the 3.48 million tonnes of organic matter processed by composting facilities in the same year. But where does the compost go after it’s been processed? The final product is sold to farms, grocery stores, garden centres and companies like GFL Ag.

Read more…

Chronic labour shortages in agriculture are putting Canada’s food security at risk

New Zealand

Did the Government get agricultural emissions levy plan right?

The anger in the animal farming community about the proposed agricultural emissions levy is understandable.

No business is happy about a new fee that they will have to pay, at least not on this planet. Add to this weather disasters, new freshwater regulations, high fuel prices; there is a lot on their shoulders at the moment.

So, was the process to develop the levy something the Government did right?

Let’s step back and look at how this all happened.

The 2019 Climate Change Response (Zero Carbon) Amendment Act specifies a 10% reduction in biologic methane emissions by 2030, to meet the nation’s 2015 commitment to the Paris Agreement.

Read More here...

Global prices for NZ food exports are coming down, but no relief for local shoppers

Global prices for New Zealand dairy and meat are coming back to more normal levels after soaring during the pandemic but shoppers here may not see the full benefit for awhile due to the lower currency.

After their bumper run over the past 18 months, global commodity prices in US dollar terms have pulled back to more normal levels, mostly due to weaker demand from China, according to ASB’s weekly commodity report.

ASB’s US dollar Commodity Price Index is now at its lowest level in about 21 months, and is sitting only about 4% above its long-run average. That’s in contrast to its peak earlier in the year, when prices in US dollar terms were 25% to 30% above normal levels.

But a decline in the New Zealand dollar is holding up prices for local exporters.

Read More here…

Shipping woes push up prices in shops, as ships queue to offload at our main ports

Woolston residents were horrified when towering stacks of shipping containers appeared mid-year on previously bare industrial land and disrupted their views of Christchurch’s Port Hills.

The thousands of mostly empty steel “boxes” stored at the Portlink freight depot are evidence of Covid-related bottlenecks at our ports, and although container mountains are diminishing as port delays ease a little, New Zealand’s shipping woes are far from over.

Vessels are still anchored out at sea for days waiting to berth, and while most Christmas stock will be here in time, prices paid by customers will reflect the higher cost of getting it here.

Capacity on international vessels is still nowhere near pre-pandemic levels, and shortages of truck drivers and stevedores are adding to slow turn around times.

Read More here…

Guy Trafford takes an overview look at where global populations are heading, and how we will feed them in the future. He checks out New Zealand’s role in that food supply

One of the things that the Russian invasion of Ukraine has highlighted is the relatively fine balance the global food supply walks.

Both countries are major grain producers which is arguably the most important of the feed staples for people and spills over to animals. Much of the most urgent requirements for the grain has been to the African continent.

It got me thinking as to where the biggest growth in population is going to occur in the decades ahead and how secure would be food production.

Up until February 24th this year climate would have been seen as the major food security threat, but Putin altered that at least temporarily however, once the Ukraine issues are resolved and the region gets back to some sort of equilibrium, climate will yet again achieve more prominence.

Read More here…

Australia

Delayed harvest pushes WA closer to 24Mt record: GIWA

A DELAYED start to harvest is fueling another likely record tonnage for Western Australian growers with a total over the record 24 million tonnes (Mt) looking increasing likely, according to the Grain Industry of Western Australia’s (GIWA) November Crop Report released today.

The later-than-normal start to harvest has been due mainly to the very cool mild conditions in spring, continuing right up until now.

While this is frustrating for some growers wanting to get their crop off, it has fueled the extra tonnes that will likely see this harvest exceed 2021’s record production.

The mild finish to the season, and rain in late August and early September, have combined to finish off a near-perfect season across all grain-growing regions of the state.

Rainfall in the central and southern half of the state over the past two weeks has further slowed the start of harvest and is now beginning to cause trouble with lodging, head loss and expected downgrades in quality if the rain persists.

Read more here

WASDE lifts Aus wheat, barley forecasts

INCREASES for forecast Australian wheat and barley exports and cuts for Argentina are among the headliners in USDA’s November World Agricultural Supply and Demand Estimates (WASDE) report released on Friday.

For Australian wheat, USDA now sees 2022-23 production at 34.5 million tonnes (Mt), up 1.5Mt from the October estimate, and exports are now seen as 27Mt, up 1Mt over the month.

WASDE cites above-average rain in Australia over the past month as supportive of crop development and boosting yields following widespread favourable conditions earlier in the growing season.

Conversely, the estimate for Argentina’s wheat crop has been cut in response to continued widespread dry conditions through most of October which have further eroded yield potential, especially in northern areas.

Read more here …

AOF pegs canola at record 6.75Mt

THE Australian Oilseeds Federation is forecasting Australia’s 2022-23 crop at 6.75 million tonnes (Mt), to break the record set in 2021-22 of 6.33Mt.

In its October crop report released on Friday, the AOF forecast for a record figure comes despite very wet conditions in New South Wales and Victoria.

These add increased uncertainty to the forecast as crops have generally withstood the wet conditions of recent months fairly well, but the ability to access paddocks for windrowing or harvesting will be limited in many cases.

Crop conditions in South and Western Australia are very good and high yields are expected, with both states expecting to deliver all-time record canola crops.

With the exception of WA, all canola-growing regions had a very wet October with decile 10-plus rainfall. In contrast, conditions in WA were near perfect, allowing crops to reach maturity with solid moisture stores, limited rainfall, and cooler-than-average temperatures.

Read mpore here…

Australia exports record 27.6Mt wheat in yr to Sep 30

AUSTRALIA exported 27.6 million tonnes (Mt) of wheat in the year to 30 September 2022, with China its biggest market by far as the destination for 6Mt, or 22 per cent, of the total.

Indonesia on 3.8Mt was the next biggest market, followed by Vietnam on 3Mt and The Philippines on 2.8Mt.

The figures have been compiled from Australian Bureau of Statistics (ABS) data, with September figures released last week.

They show 2021-22 as Australia’s biggest year for wheat exports ever, ahead of 24.6Mt shipped in 2011-12, and 24.3Mt in 2020-21.

IKON Commodities CEO Ole Houe said the China figure was notable.

Read more here…

Australia exports 5.4Mt canola in year to Sep 30

AUSTRALIA exported a record 5.4 million tonnes (Mt) of canola in 2021-22 (Oct-Sep), according to data compiled from Australian Bureau of Statistics (ABS) data.

This is more than 50 per cent above the previous record seen by ABARES at 3.512Mt and set in 2012-13, with 2020-21 on 3.496Mt and 2016-17Mt on 3.458Mt not far behind.

The 2021-22 figure includes September data released earlier this month, with Belgium on 63,350t the biggest market, followed by the United Arab Emirates on 61,408 and Japan a distant third on 35,434t.

Total canola exports for September at 176,695t were up 17pc from 151,556t shipped in August.

In the year to September 30, Germany on 1.18Mt, Belgium on 1.11Mt, France on 702,353t and Japan on 661,859t were the four biggest customers.

Read more here…

South America

Exports of Chilean fruit looking at bright future ahead

Chile’s Federation of Fruit Producers of Chile (Fedefruta) has reported exports this season could be “very good for everyone,” thanks to favorable weather, it was reported Wednesday.

“This year we see more fruit in the field, there is a strong increase, and it can be a very good season for everyone,” Fedefruta President Jorge Valenzuela was quoted by Xinhua as saying during a visit Tuesday at Santiago’s International Arturo Merino Benítez Airport cargo terminal.

“We can be optimistic” about shipping fruit exports by air “because this season the logistics conditions” have improved after the COVID-19 pandemic, Valenzuela explained while highlighting the existing “coordination between terminals, operators, and the Agricultural and Livestock Service.”

Santiago’s airport logistics can handle around 600 tons of perishable products per day, it was explained. Fedefruta also pointed out that around 70% of the flights with this type of export are passenger aircraft, while the rest are freighters, which can carry four or five times more cargo.

Read more here…

Slower Chinese demand impacts on Brazilian soybeans sales and beef prices

The Chinese economy is slowing down, the Yuan is weaker against the US dollar and Beijing is insisting with complete lockdowns in many cities because of Covid 19 or respiratory diseases, reducing considerably activity and consumption.

Soybeans imports fell 19% in October from a year earlier to 4.14 million tons, Customs 0data showed in China, representing their lowest for any month since 2014, after buyers cut purchases amid high global prices and poor crush margins.

Imports by the world’s top buyer of the oilseed were 73.18 million tons for the first 10 months of the year, down 7.4% from last year, data from the General Administration of Customs showed. The very low shipments, matching the October 2014 figure of 4.1 million tons, underline an urgent need to rebuild stockpiles.

“Crush margins have been bad most of this year which has weighed on imports,” said Darin Friedrichs, co-founder of Shanghai-based consultancy Sitonia Consulting. Global soybean prices hit a decade-high in June as bad weather cut production in Brazil, China’s top supplier.

Read More

Brazil expands agricultural storage capacity by 3%

RIO DE JANEIRO. KAZINFORM Brazil´s agricultural storage capacity reached 188.8 million tons in the first half of the year, a 3 percent growth compared to the second half of 2021. The data was released this week by the government´s statistic agency IBGE.

In the first half of this year, there were 8,378 establishments for the storage of agricultural products in the country. This number represents a growth of 2.2 percent in relation to the existing storage capacity in the second half of 2021, the survey reads, Agencia Brasil reports.

Silos predominate in Brazil, with a capacity of 96.1 million tons, followed by grain warehouses, with 70 million tons, and conventional, structural, and inflatable warehouses, with 22.6 million tons.

Among the Brazilian states, Rio Grande do Sul has the largest number of establishments (2,183), while Mato Grosso has the largest storage capacity (46.9 million tons).

Read more here

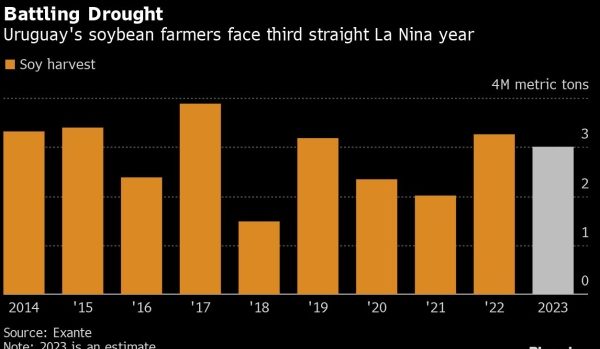

Uruguay Farmers Fend Off Droughts With Soy Technology, CEO Says

Farmers in Uruguay, which is emerging as a supplier of soybeans to giant export plants in neighboring Argentina, are withstanding climate change through investments in technology to fight droughts.

The harvest next year could reach about 3 million metric tons despite forecasts of dry weather in the River Plate region until January. That’d be only slightly lower than the 2022 crop, which benefited from timely rains, according to Montevideo-based consultancy firm Exante.

With climate change roiling farming and withering crops across South America, Uruguayan growers have embraced technology to beat the weather. In particular, they’ve invested heavily in hardier soy strains that bolster yields and in more precise applications of seeds and fertilizer, Marcos Guigou, executive director at Agronegocios del Plata, one of Uruguay’s biggest agriculture companies, said in an interview.

Read more here

Food Updates

What do US consumers want from quick service food?

A US study has revealed that women favour variety, while men place more value on staff behaviour when it comes to quick service food.

According to a new study, males and females have different expectations when it comes to quick service food (QSF).

Carried out by Clootrack, the study entitled ‘Data-Driven Customer Experience Insights from the QSR Industry’, analysed 127,990 customer reviews spanning across 19 leading brands. The data was taken from July 2021 to July 2022 and focused on trends and preferences.

Brands included in the analysis were McDonald’s, Dominos, Pizza Hut, Wendy’s, Taco Bell, Subway, Jack in the Box, Little Ceasars, Burger King, Sonic Drive-In, Papa John’s, Panda Express, Panera Bread, Whataburger, Arby’s, Noodles & Co, Sweetgreen, Chop’t, and Saladworks.

Read more here

PepsiCo UK’s innovations to save over 1,200 tonnes of emissions

With sustainability in mind, the company has stated that it has doubled its climate change goal and is pledging to reach its net-zero emissions target by 2040.

Vegetable oil to fuel trucks

Following the introduction of PepsiCo UK’s innovations, more than one million miles of truck journeys in the UK will be powered using cooking oil starting November 2022.

Read more here…

The butterfly effect: making sustainable wines that are an affordable luxury

Integrated Beverage Group’s (IBG) core mission is to change wine, and through a vigour for sustainability and transparency, it takes a novel approach to manufacturing.

Based in Dundee, Oregon, IBG uses data and science to solve real problems for both consumers and the retailers who serve them. Its core pillars include crafting the purest adult beverages on earth, providing consumer transparency and in doing so, aims to leave the world in a better place than it found it.

Replica: mastering flavour

Not only is IBG breaking ground in terms of environmental responsibility and third-party testing and certifications; the winery is also turning heads by the way it uses data and science to produce great wines – none more so than with its Replica brand.

Read more here…

Food Vision 2030: Is Ireland about to export its leadership?

To describe the Republic of Ireland, a nation rich in history and culture, as “finding its voice” seems somewhat laughable. But the small island nation is – in the words used multiple times at this week’s EFFoST 2022 Conference in Dublin – “punching above its weight” when it comes to food and beverage production and leadership.

Food has always played a massive role in the nation’s history – sometimes more so the lack of it, yet even today the food and beverage sector is a key part of how Ireland presents itself to the world. Indeed, it is the country’s largest indigenous industry, turning over some €27.5 billion and exporting a further €13 billion.

While Irish beef and Guinness might be brands well-known and loved around the world, the country is developing another food and beverage-based export too: it’s leadership.

Read more here…