USA and Canada

U.S. jumps into pea market

The United States is going to displace China in the driver’s seat of the pea market in 2021-22, says an analyst.

Pea production in the U.S. is estimated at 500,000 tonnes or about half of a normal crop.

Meanwhile, domestic consumption is estimated to remain at 850,000 tonnes, while more will be needed to fulfill at least some of the country’s export obligations.

“That shortfall in the U.S. is probably going to be the key market driver,” Chuck Penner, analyst with LeftField Commodity Research, told delegates attending the 2021 Pulse and Special Crops Convention.

He is forecasting the U.S. will need to import 450,000 tonnes of the crop, up from about 100,000 tonnes last year. The vast majority of that will come from Canada.

Read More…

Tight supply may give chickpea prices more room to grow

The chickpea bull run likely has a little more runway, says an analyst.

“It looks to me like there is still more upside possibly but maybe not up to those record levels that we had a few years ago,” said Chuck Penner, analyst with LeftField Commodity Research.

Prices topped 65 cents per pound in 2017. By comparison, posted rates last week were around 50 cents.

Even prices at today’s levels have only happened 18 percent of the time in the past 10 years.

Brian Hildebrand, a grower from southern Alberta, said he’s waiting for further price increases.

Read More

Minnesota Kernza farmers see a market for earth-friendly grain

The University of Minnesota released a new Kernza variety last year and a second variety is slated for release in 2023.

“It took us 30 years to get to this point, but we now have what I call real crops that have real possibility for the marketplace and for planting by farmers,” said Wyse. “And it’s really, really exciting.”

Perennial crops can help reduce the environmental impact of agriculture, and they fit well with the regenerative agriculture movement that focuses on soil health.

The largest crop yet of Kernza was recently harvested. Research shows Kernza improves water quality by reducing fertilizer pollution of water, and it can efficiently store carbon in the soil, helping reduce carbon dioxide, a greenhouse gas.

Read More…

Soy stages surprise rally after September WASDE

Corn prices edged lower this morning after USDA found an additional 600,000 acres of corn planted across the country in the latest Crop Production and World Agricultural Supply and Demand Estimates reports released this morning.

Corn yield estimates jumped up 1.7 bushels per acre on improving crop prospects, sending new crop ending stocks to 1.41 billion bushels and triggering minor bearish price movement in the corn complex. December 2022 futures held steady above the $5/bushel benchmark, suggesting that today’s report was not as bearish as the trade had originally been expecting.

Soybean prices experienced a 1.4% rally on 300,000 fewer soybean acres planted this year, despite a 0.6 bpa increase in yields from USDA’s August estimate of 50.0 bpa.

Lentil yields could take further drop this fall

Canada’s undersized lentil crop could be getting even smaller, according to analysts.

Marlene Boersch, managing partner of Mercantile Consulting Venture, is currently forecasting a national average yield of 1,045 pounds per acre, 23 percent below the five-year average.

That is slightly above Statistics Canada’s estimate of 1,030 pounds per acre.

However, based on Mercantile’s analysis of early crop yields by district in Saskatchewan, that number could fall as low as 855 pounds per acre.

She is not ready to drop her estimate to that level just yet, but it is a sign there could be further downward revisions in the fall and winter months.

Read more…

New Zealand

Dairy prices jump 4% at auction, the biggest gain in six months

Dairy prices jumped 4 per cent at the global auction overnight, the biggest increase in six months, with gains across all products.

The global dairy trade price index posted its biggest increase since early March, when it jumped 15 per cent. The index had fallen 13 per cent since then, before the latest bounce.

The average price for whole milk powder, which has the most impact on what farmers are paid, increased 3.3 per cent to an average US$3691 (NZ$5200) a tonne, with gains across all contract periods. The average price is sitting 24 per cent higher than at the same time last year.

Fonterra has been reducing the amount of whole milk powder it offers on the auction platform, saying it has “extremely strong” contract demand and expectations for flat milk supply this season will limit its ability to increase production.

Read More here…

Grower warns Kiwis to pay more for produce as Pacific RSEs ‘nowhere near enough’ to meet labour shortage

Produce growers have been anxiously waiting to see if recognised seasonal employer (RSE) workers would still be allowed into the country given the current Delta outbreak.

On Friday, the Government announced workers from Samoa, Tonga and Vanuatu would be able to come into New Zealand quarantine-free from next month.

But one grower says that’s still not enough, warning the labour shortage will result in Kiwis paying more for fruit and veg.

Apple blossoms are a sign of fruit coming to life. While it’s a pretty picture, the situation with the lack of horticulture workers is anything but.

Read More here…

The carbon price is now high enough to change land-use sufficiently to blow away sheep and beef, but too low to significantly influence emission behaviours elsewhere

The concept of ‘carbon farming’ has been around for a long time. I recall carbon farming discussions with my colleagues at University of Queensland back in the early 1990s, but the industry has taken a long time to finally arrive. Well, it is now here. And it has the potential to overwhelm not only the sheep and beef industries, but also have big impacts on the timber industry.

It is only six weeks since I wrote an article setting out that carbon farming is now considerably more attractive than sheep and beef on the hard North Island hill country. Then two weeks later I extended that analysis to the easier hill country. In a more recent article focusing on the Emission Trading Scheme (ETS), I mentioned that the same conclusion could be drawn for considerable parts of the South Island. All of those can be found archived here.

Read More here…

Despite all the external political pressures, buyers want our dairy products and are bidding up prices, reports Guy Trafford. Sadly, Synlait isn’t benefiting

The latest Global Dairy Trade dairy product auction took place in the early hours and the current trend of decline has fortunately been arrested and reversed. All categories of product Fonterra puts up have shown increases:

SMP lead the way with a +7.7% increase, and WMP rose +3.3%. Butter and Cheddar rose by +3.7% and +3.6% respectively.

According to the Westpac update, the SMP rise indicates a reduction in supplies coming out of Europe.

Angus Kebbell talks to scientist Sinead Leahy about why and how the rural community needs to respond to the climate crisis, and why not responding will be worse for our rural businesses

Although the Climate Commission’s latest report broadens the responsibility for meeting New Zealand’s climate targets to every sector of the economy (and especially the transport sector), there is no escaping the need for the agricultural sector to adapt significantly further, to ensure these national targets are achieved.

For farmers, they need to realise that our customers are demanding change. And our customers are international. This is a powerful market signal that must be responded to if we are to have markets for our products.

Sinead Leahy is a senior science adviser at the New Zealand Agricultural Greenhouse Gas Research Center in Palmerston North.

Read more here…

Australia

Grain tail winds set to favour Aussie growers

AUSTRALIA is poised to take advantage of strong fundamentals in the global grains sector according to Lachstock Consulting chief executive Nick Carracher.

Speaking prior to the Australian Grains Industry Conference this week Mr Carracher said domestic and international factors were falling into line for a positive season.

“It’s going to be a big year for the new crop,” Mr Carracher said.

Speaking before weekend rain, Mr Carracher said the Mallee needed a drink, but other areas looked good and with the Mallee receiving good falls over the weekend most areas are now in at least reasonable condition.

Read more here…

September has arrived and the harvest countdown underway

September has arrived and the countdown to the Queensland wheat and barley harvest is under way.

After a cold front and associated trough resulted in widespread rain across Victoria and NSW late last week, weather will turn drier and warmer. Overall, temperatures will climb to the mid to high 20s by the middle of the week. The absence excessive heat is conducive for crops to maximise available soil moisture as they mature in the coming weeks.

National winter grain production expectations were bolstered by last week’s rain across NSW and Victoria.

Victoria received a general 15-20mm on Thursday and Friday to the relief of farmers after below average winter rainfall across large areas of the state.

Read more here…

Harvesters urged to have COVID movement plans in place

WITH COVID-19 state border restrictions still firmly in place and unlikely to ease any time soon, lobby group Grain Producers Australia is urging grain growers and harvest contractors to have a clear plan regarding logistics this harvest.

There are still permits available for those in the agricultural sector to cross borders closed to the general public, however there have been many reported incidents with border crossing systems and GPA is warning the industry to be well prepared to ensure the projected 50 million tonne plus crop comes off in a timely manner.

“While there’s a positive outlook with good prices, we can’t take anything for granted,” said outgoing GPA chairman Andrew Weidemann.

Read more here

Tight wheat supplies push up values

Global wheat supplies have tightened, pushing wheat values in a range of markets to their highest values since 2008. We see that in our own market, with the $A value of Chicago Board of Trade futures continuing to trade in a range not seen since the massive price spike in early 2008.

Our cash market for both new and old season wheat is reflecting this as well, with new season prices moving above $350 a tonne, and close to $380/t in WA. Price levels like these have traditionally been reserved for drought years, with our market responding to domestic issues, not international price levels.

The various futures markets around the world will continue to bounce around as final harvest results from the northern hemisphere get bedded down. The markets will also be watching the Australian crop, to see how big it can get, and whether it will balance out some of the ongoing downgrades being put forward for the Russian, European Union and Canadian crops.

Read more here …

Mango Hybrids enter next phase of commercial development

THREE mango hybrids will soon transition to the next phase of their commercial development, with the Department of Agriculture and Fisheries taking over role as lead licensor.

The varieties, currently known as NMBP-1201, NMBP-4069 and NMBP-1243 were produced during the National Mango Breeding Program and are currently grown by more than 20 producers on orchards in Western Australia, the Northern Territory, Queensland and New South Wales.

The breeding rights to these mangoes are currently protected by Plant Breeders Rights granted through IP Australia.

Read more here…

South America

Brazil imports record volumes of Argentine corn to feed poultry and pork

While Brazil is complying with the last shipments of corn contracted earlier and at a lesser rhythm and volume than a year earlier, imports of the grain compared to 2020, have more than doubled this year, mainly from Argentina.

So far Brazil has purchased 1,3 million tons of corn, and in the first three days of September it already has unloaded 65.700 tons against 147,000 tons for the whole same month in 2020, points out Secex, the country’s Foreign Trade Secretariat.

And this is only the beginning according to companies that have purchased Argentine corn and are to be delivered in coming weeks. The scarcity of the grain needed to feed poultry, pork and feedlots has forced to appeal to Mercosur associates supplies.

Read More here…

Brazil’s ‘mad cow’s care over; China willing to continue purchasing beef

The quick reply from the World Animal Health Organization, OIE, acknowledging that the two cases of ‘mad cow’ reported in Brazil were atypical and China’s willingness to accept the diagnosis, according to the Brazilian Ministry of Agriculture should strongly mitigate the impact on beef exports to China and Hong Kong.

However the consequences on the cattle live market should be minimal since this is a short week in Brazil, Tuesday was a national holiday, Independence Day, and abattoirs are in no hurry to purchase, and want to take advantage of the BSE cases lull.

Furthermore according to Cattle breeders association, “many farmers were forced to sell their fat steers because of the ongoing drought and early frosts, plus the fact that higher grain prices forces farmers to think twice before feeding cattle”

Read More here

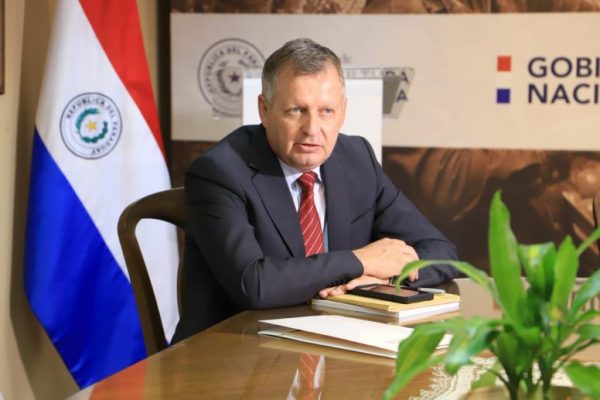

Paraguayan minister praises FAO’s project for family farming products

Paraguay’s Agriculture Minister Moisés Santiago Bertoni Tuesday highlighted the cooperation framework his country will have with the United Nations (UN) Food and Agriculture Organization (FAO) for the period 2022-2031.

The official also reaffirmed Paraguay’s commitment to the 2030 Agenda and addressed the importance of guaranteeing the resilience of production systems and at the same time generating mechanisms that ensure sustainability.

Bertoni made those remarks during FAO’s launch of the global initiative “One country, a priority product,” to develop sustainable value chains and support small farmers to reach international markets.

Read more here

Food Updates

High-fat diets could disrupt the body clock and lead to obesity

New research has suggested that a high-fat diet can disrupt our body clock and affect how full and sated we feel – leading to overeating and potentially obesity.

When rats are fed a high fat diet, this disturbs the body clock in their brain that normally controls satiety, leading to over-eating and obesity. That’s according to new research published in The Journal of Physiology.

The number of people with obesity has nearly tripled worldwide since 1975. Obesity can lead to several other diseases such as Type 2 diabetes, heart disease, stroke, and some types of cancer.

Those behind the research are confident it could become a cornerstone for future clinical studies that could restore the proper functioning of the body clock in the brain, to avoid overeating.

Historically, it was believed that the master body clock was only located in a part of the brain called the hypothalamus.

Read more here…

Could food waste soon be used to power data centres?

Researchers from Virginia Tech are entering the final stages of research that could soon see food waste used to manufacture batteries to power things like data centres.

Could your leftover apple core one day be used to power a data centre? Scientists from Virginia Tech are hoping to achieve exactly that, as they investigate how food waste and its associated biomass can be converted into rechargeable batteries.

“This research could be a piece of the puzzle in solving the sustainable energy problems for rechargeable batteries,” said project co-lead Haibo Huang, an associate professor in the Department of Food Science and Technology in the College of Agriculture and Life Sciences.

Read more here…

Yum China launches healthy eating initiatives

Yum China has unveiled a series of heathy initiatives as it looks to promote healthy eating across its restaurants in China, including an option to add fruit and vegetables to meals in some of its best-known brands.

Yum China has announced the launch of a new campaign to promote balanced diets by offering customers more fruit and vegetable options in its restaurants in China. The campaign will launch simultaneously today (13 September) at over 6,000 KFC, Pizza Hut and Taco Bell stores nationwide, before gradually expanding to more stores.

A core component of the campaign is the “Fruit and Vegetables 100+” programme that encourages customers to add at least 100g of fruit and vegetables to their meals. Yum China says that KFC, Pizza Hut and Taco Bell will also launch a series of new and updated fruit and vegetable-based products in China, while leveraging their digital platforms to raise public awareness of nutrition and healthy eating.

Read more here…

Big moments for food labels on the horizon

As we see a number of changes in the way in which foods are labelled, Professor Chris Elliott offers his expert insight on the current and future landscape.

What’s on the label of the food we buy is meant to inform us and guide what purchase we should make. While companies do set out to provide such details, they also view labelling as one of the most important means of marketing. The ‘information’ ranges from large, brightly coloured text, to numbers and copy that you’d need a magnifying glass to read.

The legislation on labelling is highly complex and will soon become even more complicated with the introduction of Natasha’s Law in the UK. While this is a very positive addition to protect those with food allergies, many businesses are still feeling unprepared for the legislation which will come into enforced in less than a month (October 2021)

Read more here…

Is the wine industry inclusive?

Bethan Grylls and Mecca Ibrahim interview a number of wine experts to find out whether the sector, which has been deemed as not diverse enough, has made any significant improvements.

f the wine sector wants to survive, it must have a drastic rethink about the way in which it represents and relates to the world today.

In this article, Mex and I teamed up to look at the wine sector, which has been called out for its lack of diversity, to see how it’s faring today.

This article includes references to previously published work, interviews we conducted ourselves, and quotes taken from a session at the Unified Wine & Grape Symposium – a trade show held each year in Sacramento, California, US, entitled Strength in Diversity: Achieving Meaningful Change for Business Success in the Wine Industry.

Read more here…